Three Key Metrics Suggest Bitcoin Could Dip to $40,000

Key Takeaways

Bitcoin recently bounced off support to hit a high of $48,500.

Regardless of the upswing, on-chain metrics hint at a bull trap.

A sustained close outside of the $46,000 to $51,000 range will determine where BTC is heading next.

Share this article

Bitcoin’s network activity suggests that a spike in profit-taking is imminent. Still, only a decisive break of the $46,000 support level is likely to lead to a steep decline.

Bitcoin On-Chain Metrics Turn Bearish

Bitcoin could soon experience a retrace.

The leading crypto asset has rebounded by nearly 4.6% over the last few hours after hitting a low of $46,300 on Aug. 26. The sudden upswing has caught investors by surprise, generating over $64 million worth of long position liquidations across the board.

Despite the recent spike in volatility, several on-chain metrics suggest that a sell-off could be be underway.

Behavior analytics platform Santiment recently recorded one of the most significant Bitcoin inflows to exchanges in over two years. Roughly 1.68 million BTC were transferred to trading platforms, which “tied for the largest inflow day of all-time.” Such market behavior coincides with a steady increase of more than 60,000 BTC held on trading platforms since Aug. 3.

The rising Bitcoin supply on exchanges suggests that investors could be preparing to realize profits soon, igniting a sell-off that pushes prices lower.

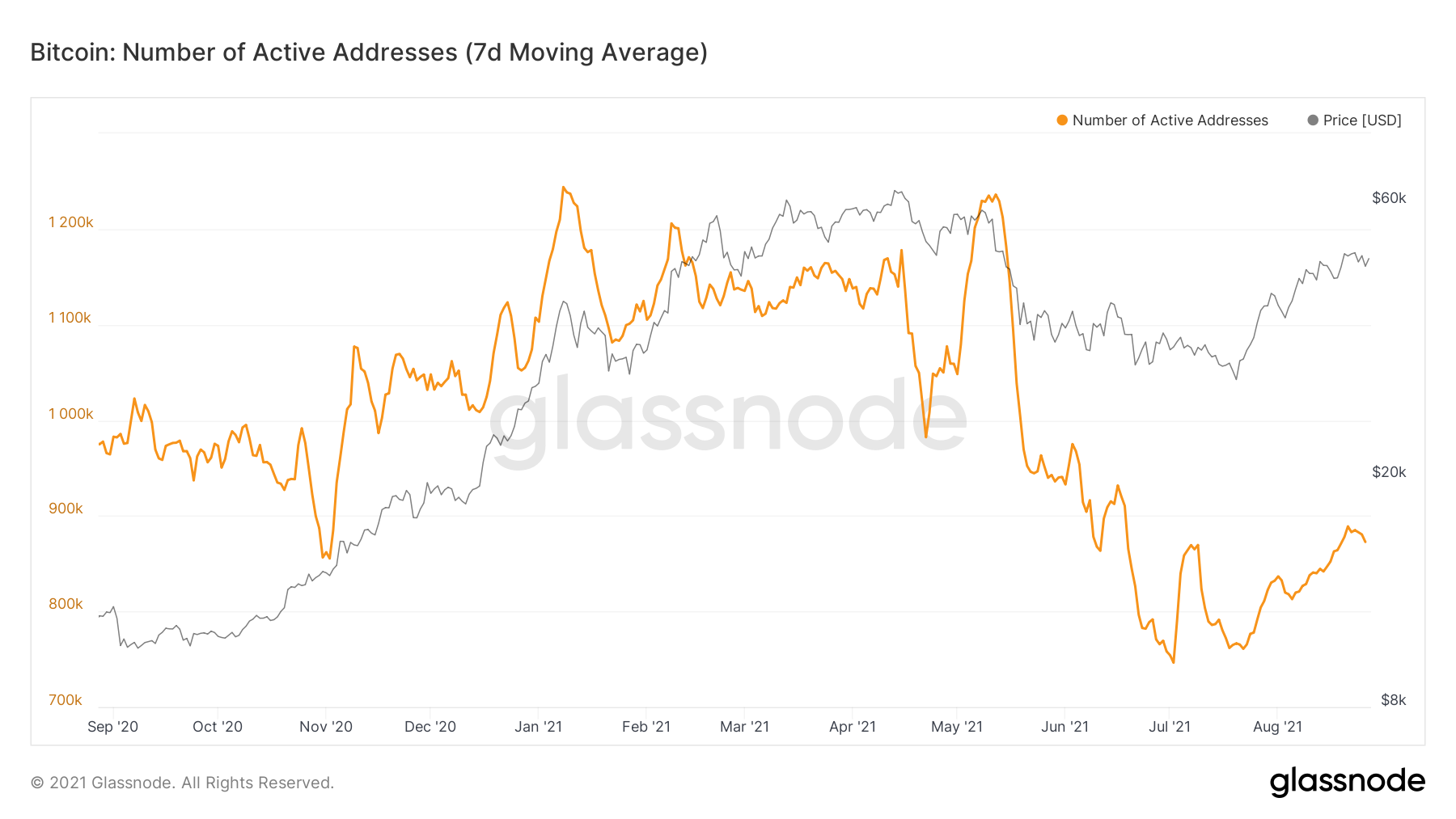

When considering the decreasing number of daily active addresses on the Bitcoin network, the inflow activity on exchanges becomes even more concerning.

Twitter user Nebraskan Gooner maintains that an influx of buyers is usually determined by a spike in the number of new addresses being created. But when this on-chain metric is declining, it suggests less interest from retail investors. He wrote:

“[In 2018,] we never saw a large influx of active wallets until we finally reached the bottom. Address activity dropped, fewer new market participants were getting involved (along with old), and volatility dropped as BTC went sideways/corrected,”

Now, the analyst believes that those who wanted to unload their Bitcoin on the market could have already done so and are now “waiting for lower prices like in 2018.”

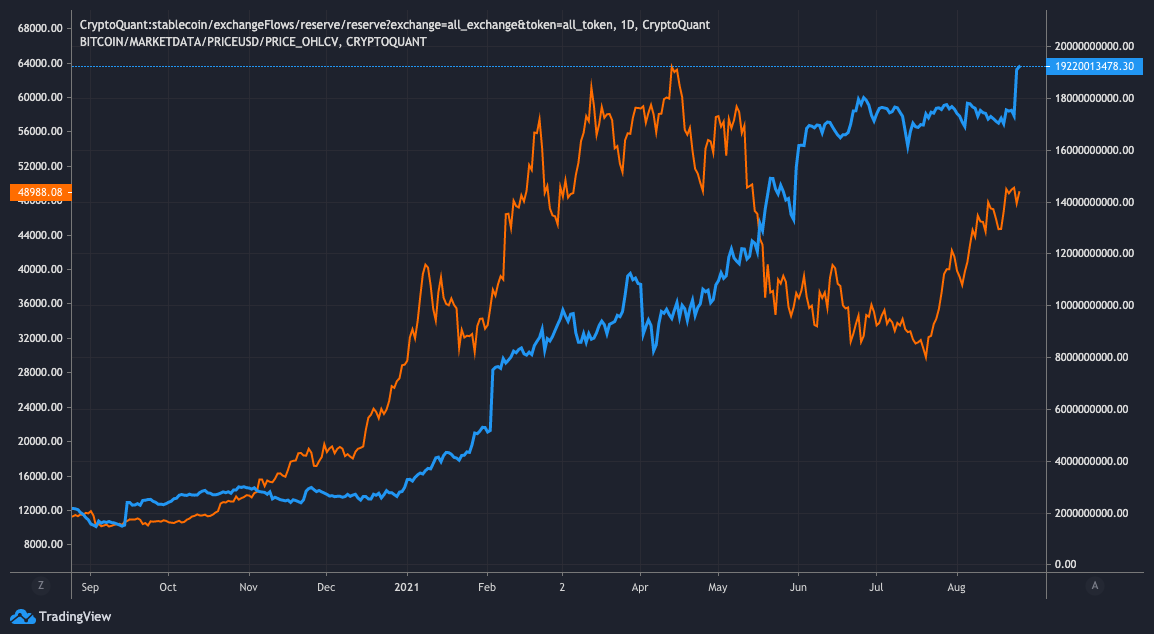

Another sign that shows that investors could be cashing out is the rising supply of stablecoins on exchanges, which recently hit a new all-time high at around $19.22 billion. Some market participants may argue that such an important spike is positive as it signals more dry powder in the system that could flow into Bitcoin.

Still, given the increase in BTC supply on exchanges, the data suggests that investors are converting their holdings into cash.

While it’s still unclear where Bitcoin is heading next, it is crucial to pay attention to the $46,000 support level and the $51,000 resistance barrier. A decisive daily candlestick close below the underlying demand wall could lead to a downswing toward $40,000, while a sustained move above the overhead supply could lead to a rise to $57,000.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

MicroStrategy Spends Another $177M on Bitcoin

Virginia-based software and data analytics company MicroStrategy has added another 3,907 Bitcoin to its balance sheet. MicroStrategy Keeps Stacking Bitcoin Whereas most retail investors can only afford to “stack sats,”…

Morgan Stanley Owns Over One Million Grayscale Bitcoin Shares

Morgan Stanley analysts think Bitcoin has “a long way to go.” Morgan Stanley Keeps Increasing Bitcoin Exposure According to a Wednesday SEC filing, the world’s third-largest wealth manager, Morgan Stanley,…

How to Trade Using the Inverse Head and Shoulders Pattern

In stock or cryptocurrency trading, you may have heard of the term “inverse head and shoulders.” Also known as the “head and shoulders bottom” formation, the inverse head and shoulders chart pattern can…

Argentina May Adopt Bitcoin to Curb Inflation

Argentine president Alberto Fernández has made several positive comments regarding cryptocurrencies, suggesting that the country could adopt Bitcoin to curb its rampant inflation. Argentina Eyes Bitcoin Adoption Argentina joins the…