The US Government Wants You To Know It’s Cracking Down on Crypto

2 years ago CryptoExpert

The jokes wrote themselves.

On Wednesday, the U.S. Department of Justice declared ominously that it would hold a live press conference at noon to announce an “International Cryptocurrency Enforcement Action.”

Crypto Twitter panicked, and so did crypto prices. Bitcoin and Ethereum each fell nearly 5% in just a few minutes, amounting to a flash crash. What big player was caught in the DOJ’s crosshairs? Binance was a popular bet, and CZ didn’t help matters by tweeting just “4,” which he announced on January 2 is his new signal for incoming “FUD, fake news, attacks, etc.”

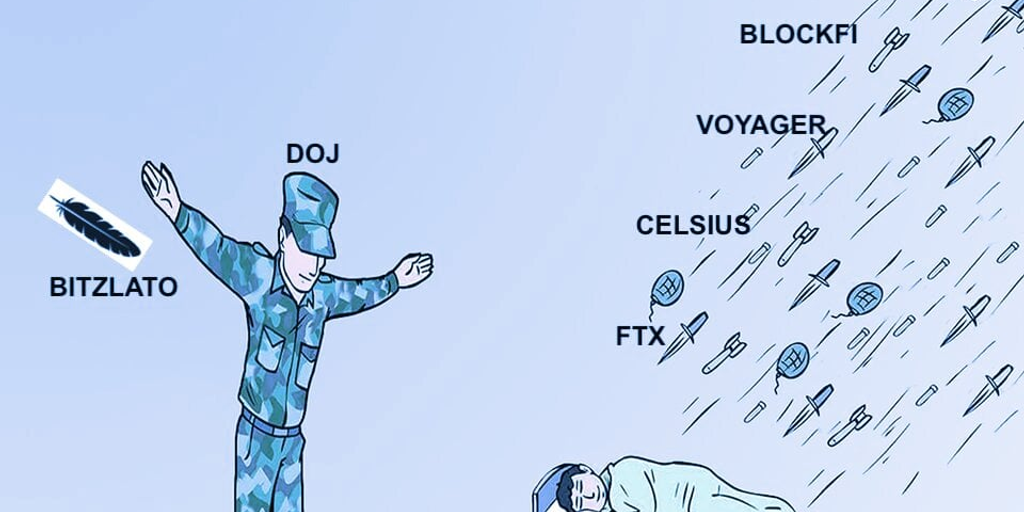

Then the press conference happened. It wasn’t Binance. It wasn’t Celsius, or Voyager, or Blockfi, or any other bankrupt crypto lender that screwed over its customers. It was a Hong Kong-based, Russian-owned crypto exchange called Bitzlato.

Bitz-what? Bitzlatte? I’ve been writing about crypto since 2011, and never heard of it.

Bitzlato, the DOJ said, processed more than $700 million in illicit funds, including millions in proceeds from ransomware.

Okay. But as of January 18, Bitzlato customer wallets had… $11,000 in them, according to a Coinbase operations director. At Bitzlato’s peak, customer wallets held $6 million—a trifle.

And yet DOJ Deputy Attorney General Lisa Monaco touted the enforcement action as “a significant blow to the cryptocrime ecosystem.” She said Bitzlato, “fueled a high-tech axis of cryptocrime.”

The crypto market quickly rebounded.

I could embed a bunch more of the best memes on this, but let’s move on to the Why, and the What This Means.

The DOJ is attempting to flex.

People in crypto laughed at it, but those outside crypto probably didn’t. The U.S. government wants to make crystal clear—especially after the massively scrutinized collapse of FTX—that it is aware of CRYPTO CRIME (!) and is taking decisive action.

The DOJ has reportedly been investigating Binance since 2018, and according to Reuters is split over whether to bring charges. It’s been rumored that the DOJ is also investigating Digital Currency Group, owner of crypto lender Genesis, which filed for bankruptcy this week.

And the DOJ isn’t alone: the SEC charged both Genesis and Gemini at once last week for violating securities laws.

SEC Commissioner Hester Peirce, in an interview on our gm podcast last month, was reluctant to say outright that the FTX meltdown will lead directly to more crypto regulation. But it’s clear that at the very least it has already led to more posturing. And Peirce did say she hopes it won’t lead her peers to overreact with hasty restrictions.

“I think we should all be on the lookout for regulatory frameworks that are developed in the context of enforcement action, because it’s a very tempting thing for regulators to do that,” Peirce said. “And it just cuts everybody else out of the process.”

I frequently say that people in crypto have an irrational fear of the very word “regulation.” They presume regulation means shutting down entirely, when regulation could—in an ideal scenario for all—simply mean creating new safeguards for retail investors.

That said, what Sam Bankman-Fried hath wrought is a new climate in which regulators and politicians are feeling more pressured than ever before to show they’re serious about ridding crypto of the bad actors. And that could lead to overreach. We already saw it last year with Tornado Cash.

The next big hyped enforcement action may not be against some small-time player.