Tether Grows 2.3% as Stablecoin Economy Loses $2.4 Billion in Value Since March 31 – Altcoins Bitcoin News

While several top digital assets have decreased in value against the U.S. dollar over the past month, the stablecoin economy has lost $2.4 billion in value since March 31, 2023. Four of the top five stablecoins experienced net redemptions over the last 30 days, except for tether, which grew by 2.3% during that time.

Four of the Top Five Stablecoins Experience Net Redemptions in the Past 30 Days

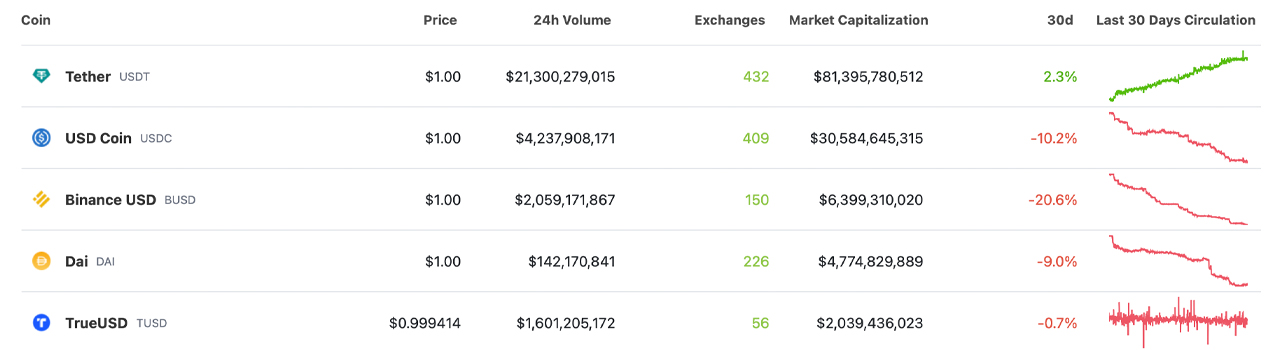

On March 31, 2023, the top stablecoins by market capitalization represented $133.63 billion in value, and now the valuation is down to $131.21 billion. A total of $2.4 billion worth of stablecoins has been withdrawn from the stablecoin economy since then. Data reveals that over the past 30 days, USDC, BUSD, DAI, and TUSD have all seen redemptions. Usd coin’s (USDC) circulating supply dropped 10.2% compared to last month, and binance usd (BUSD) fell by 20.6%. Of the top five largest stablecoins, both USDC and BUSD experienced the most redemptions.

Further, DAI’s circulating supply slipped 9% lower in 30 days and TUSD’s supply decreased by 0.7%. Tether (USDT), however, grew 2.3% since last month, reaching a market capitalization worth $81.39 billion. Tether’s market valuation accounts for 61.65% of the entire stablecoin economy’s $131.21 billion value. While tether’s supply grew by 2.3%, pax dollar (USDP) rose by 33.9% since last month.

USDP now has a market valuation of approximately $1,037,832,268. Both frax dollar and Tron’s USDD experienced losses during the past 30 days; frax dollar (FRAX) shed 3.8% while USDD lost 1% of its circulating supply. Gemini’s dollar-pegged token GUSD saw its supply increase by 18.1% to $465.22 million. Liquity usd (LUSD) recorded a 2.4% rise, and magic internet money (MIM) increased by 5.9% last month. The entire stablecoin economy represents 11.02% of the crypto economy’s $1.19 trillion net value.

What does the recent decline in the stablecoin economy mean to you? Share your thoughts about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.