Stablecoin Economy Continues to Deflate — USDC’s Market Cap Shed $6.7 Billion in 83 Days – Altcoins Bitcoin News

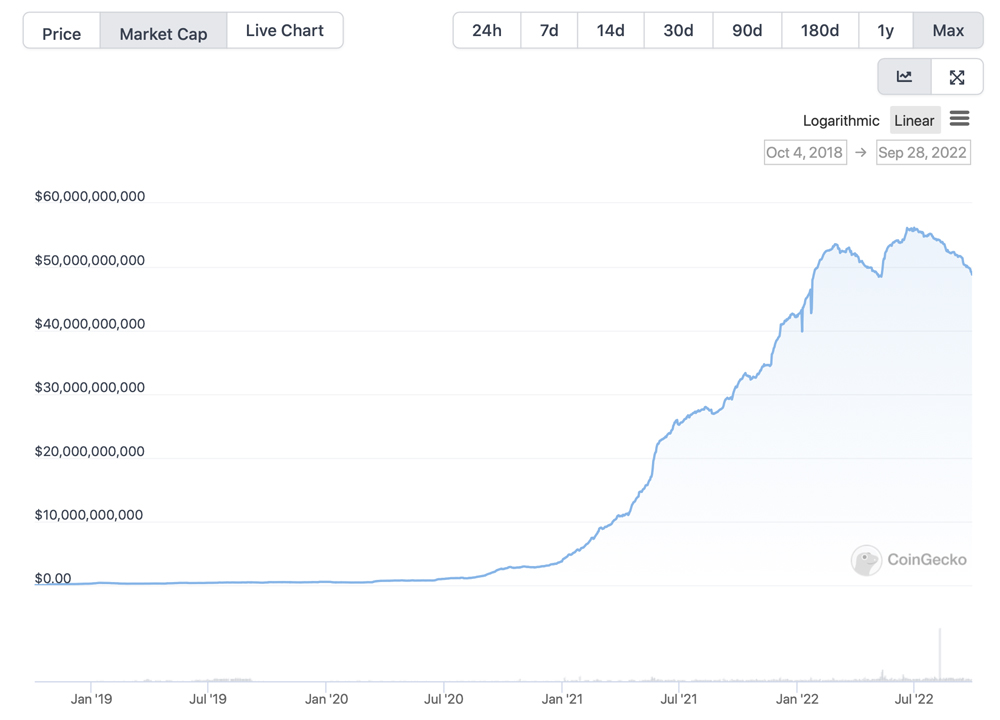

Just over two months or approximately 83 days ago, the stablecoin usd coin (USDC) had a market valuation of around $55.52 billion and since then, USDC’s market capitalization has lost 12.05%. For most of 2022, the second largest stablecoin by market capitalization, USDC has been above the $50 billion mark, but this week the crypto asset’s market valuation is around $48.82 billion.

Following Tether’s Recent Stablecoin Reduction, USDC’s Market Cap Drops 12%

In mid-June, Bitcoin.com News reported on the largest stablecoin asset tether (USDT), as USDT’s saw more than $12 billion erased from the market cap in two months and at that same time, usd coin’s (USDC) market cap rose by 9%.

However, USDC’s market cap has shrunk a great deal during the last 83 days, as it has dropped by $6.7 billion since July 7, 2022. At the time of writing, at 4:15 p.m. (ET) on Wednesday afternoon, USDC’s market valuation is $48.82 billion and on July 7, it was much higher at roughly $55.52 billion.

USDC’s market cap today is under the $50 billion zone but for most of 2022, the stablecoin’s market valuation remained above that region. On February 1, 2022, USDC captured the $50 billion mark, in terms of market capitalization, and it remained above that region until April 17.

After May 13, USDC once again reclaimed a market valuation above the $50 billion zone, and it remained that way for roughly 130 consecutive days. While USDC’s market valuation shrunk by 12.05% during the last 83 days, 6.6% of the loss was erased from the market cap during the past 30 days.

USDC’s market cap drop follows the company’s recent partnership with Robinhood Markets, but it also follows the recent auto-conversion moves by Binance and Wazirx. Both Binance and Wazirx auto-converted their customer’s USDC holdings (and other stablecoins) into BUSD if they did not withdraw the USDC by a specific date.

Today, on September 28, statistics indicate that USDC has roughly $4.31 billion in 24-hour global trade volume. The stablecoin’s market cap dominance represents 4.985% of the crypto economy’s $983 billion in fiat value. USDC’s top trading pair today is tether (USDT) as it accounts for 32.25% of today’s usd coin trades.

Tether is followed by EUR (27.16%), USD (22.56%), and GBP (6.51%) in terms of USDC’s top pairs on Wednesday. Stablecoins like tether (USDT) and usd coin (USDC) have seen a significant rise in euro and pound trading pairs since both fiat currencies started to slide against the greenback.

What do you think about USDC’s market valuation sliding by more than 12% during the past 83 days and 6.6% over the last 30 days? Let us know what you think about this subject in the comment section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.