Solana, Avalanche Struggle as Investors Lose Confidence

Key Takeaways

Solana and Avalanche have each dropped over 30% in the last 72 hours.

Both Layer 1 tokens are now testing crucial support areas and their futures look uncertain.

In the meantime, investors continue exiting the markets amid an overall decline in the crypto market.

Share this article

Solana and Avalanche seem to have reached a crucial demand wall after seeing their market value drop by more than 50% over the past few weeks. Still, the lack of buyers at current price levels is a warning signal.

Solana and Avalanche at Weak Support

Layer 1 tokens SOL and AVAX have crumbled as fear and despair echo across the cryptocurrency market.

Solana has plummeted by more than 36% over the past three days, going from a high of $75 to hitting a low of $48 recently. The steep correction pushed SOL to test the lower boundary of a parallel channel at $51.60, where it has been contained since September 2021.

Such a vital demand zone would have to hold to prevent the Layer 1 token from incurring further losses.

The measurement of the channel’s width suggests that a decisive weekly close below the $51.60 support level could trigger a 50% correction. Under such unique circumstances, Solana could crumble under selling pressure toward $26 or lower.

The eighth-largest cryptocurrency by market cap must hold above the channel’s lower trendline at $51.60 for a chance of recovering some of the recent losses. Price history shows that each time SOL has rebounded from this support level, it has tagged the channel’s middle or upper boundary. Similar price action might result in an upswing to $70 or even $95.

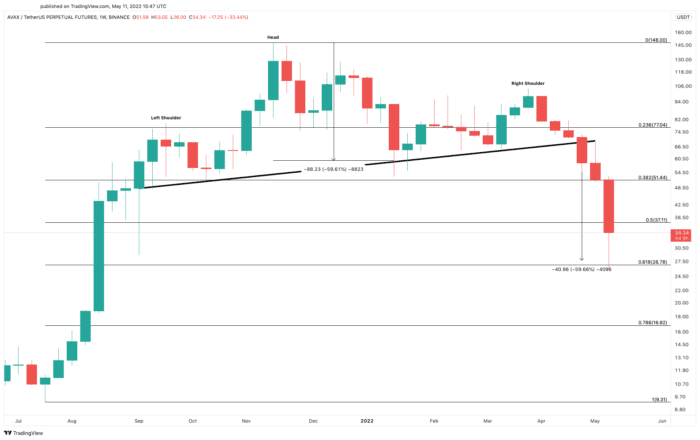

Avalanche also took a significant nosedive over the past three days. The Layer 1 token crashed by nearly 50% after losing its $51.60 support level. The steep downtrend appears to be part of a bearish breakout from a head-and-shoulders pattern that developed on AVAX’s weekly chart.

Now that Avalanche has reached the $28 target presented by this bearish technical formation, it remains to be seen whether it can gain the strength to rebound.

The precarious market conditions suggest that lower lows can be expected. But for that to happen, AVAX would have to print a weekly candlestick close below $27. Breaching this vital demand zone could encourage further selling among market participants, resulting in a downswing to $17 or even $10.

On the other hand, bulls would have to bring Avalanche above $37 and defend this level to invalidate the pessimistic outlook. Accomplishing such a difficult task could encourage sidelined investors to reenter the market, pushing AVAX to $51.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.

For more key market trends, subscribe to our YouTube channel and get weekly updates from our lead bitcoin analyst Nathan Batchelor.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Maple Finance Expands to Solana

Maple Finance, the decentralized marketplace for institutional lending, has launched on Solana. Alongside its partners, Maple will introduce a $45 million pool to initially grow its Solana ecosystem. Maple Finance…

Avalanche’s Ava Labs Set to Hit $5.25B Valuation: Report

Ava Labs, the development company behind the Avalanche blockchain, is reportedly set to raise $350 million at a $5.25 billion valuation. Avalanche Developer Plans Raise Ava Labs Inc., the development…

2017-Era Layer 1s Are Showing Signs of Life (Somewhat)

EOS, Zilliqa, and Internet Computer, three early Layer 1 crypto networks, are gaining bullish momentum. The recent gains could extend over the week as resistance weakens. EOS Makes a U-Turn…