Ronin Sidechain Processed 560% More Total Transactions Than Ethereum Last November – Blockchain Bitcoin News

The blockchain-powered game Axie Infinity has been a very popular application during the last 12 months, as the game’s NFTs have outpaced every NFT collection today in terms of all-time sales. While Axie Infinity has seen $3.85 billion in all-time sales, Nansen researcher Martin Lee recently published a report on how Ronin, Axie Infinity’s sidechain, has seen exponential growth.

Researcher Takes a Deep Dive Into Axie Infinity’s Ronin Network

Axie Infinity, the Ethereum-based blockchain game developed by Sky Mavis has seen a significant amount of NFT sales surpassing every NFT compilation released to date. Out of 1.44 million buyers across 12.6 million transactions, Axie Infinity has seen $3.85 billion in all-time sales. However, even though Axie Infinity is an Ethereum-based game, the protocol leverages the sidechain Ronin to help alleviate scaling issues. In the introduction to Axie Infinity’s Ronin, Nansen researcher Martin Lee explains that Ethereum’s Layer one (L1) “was not built for gaming.”

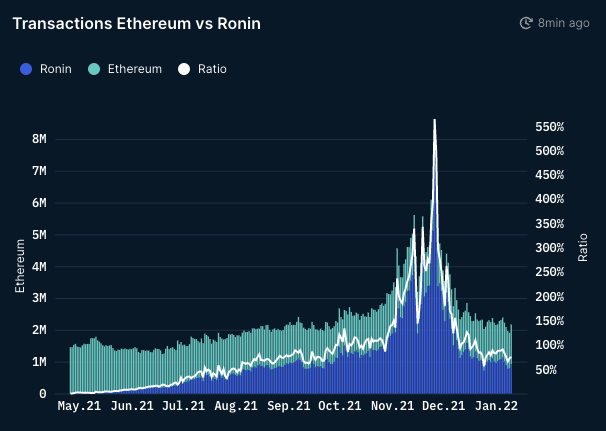

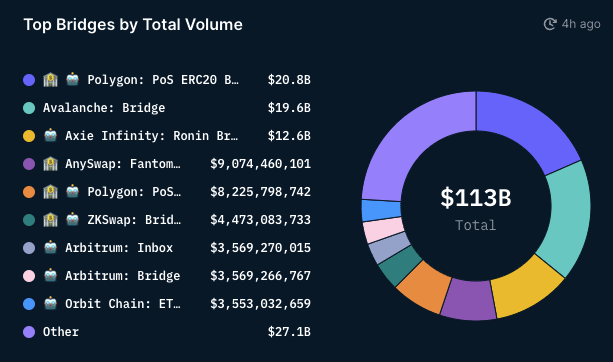

To handle the issue with high fees and scaling problems, Axie Infinity’s development team created the Ronin sidechain to help facilitate transactions in a faster and inexpensive fashion. Lee’s research report compares Ronin to the sidechain protocol Polygon and the Layer two (L2) blockchain Arbitrum One. The study also explains how the Ronin sidechain has its own native wallet in order to handle sidechain transactions. Interestingly, when it comes to scaling Lee’s report shows that last November, “Ronin processed over 560% of the total number of transactions on Ethereum.”

“While there is no official documentation on the max TPS (transactions per second) of the Ronin network, it has a block time of ~3s (ETH averages ~13s),” Lee’s study highlights. “Executing trades on the Axie marketplace and sending assets over the network are completed within seconds.” The researcher’s report also highlights a comparison of gas fees as the study’s author states:

Gas fees on Ethereum hover between 50-100 gwei making micro-transactions uneconomical. Ronin, on the other hand, offers 100 free transactions per wallet per day. In the future, there will be a small fee once the $RON token is released, but it will likely cost less than $1.

Study Envisions Other Developers Leveraging Ronin, Nansen Researcher Concludes ‘It’s still early days for Ronin’

The study also delves into the Axie Infinity decentralized exchange (dex) platform called Katana. Lee’s report highlights how the multi-chain layering works and the fact that when it comes to gaming applications specifically, L1 networks cannot adjust beyond their main specialization. “A lot of blockchains, whether they like it or not, will specialize,” Lee stressed in the report. Lee further noted that when Ronin grows mature and stable, “other games developers can start to build their games on Ronin.” Lee’s report continues:

Despite launching less than one year ago, the Ronin network has proven itself to be a capable scaling solution for gaming. The birth of Ronin ushered in the rise of Axie Infinity and the Gamefi/Play-to-earn wave.

Lee’s study draws the inference, that while the network does have flaws and is “more centralized than the community would like,” the developers’ Sky Mavis “made consistent steps to decentralize it.” The report notes the distribution of RON tokens and the LPs on the Katana dex. “It’s still early days for Ronin and it will be interesting to see how the blockchain develops and grows over time. Will Ronin become the go-to blockchain for gaming? Only time will tell,” Lee’s study concludes.

What do you think about Nansen researcher Martin Lee’s study on the Ronin network and how it has outperformed some L1 networks in recent times? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Nansen Research, Martin Lee

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.