Monero Supporters Beg XMR Miners to Boycott Mining Pool Capturing 44% of the Network Hashrate – Mining Bitcoin News

Reports indicate that the Monero community is upset about a specific mining pool that currently commands 44% of the network’s hashrate. Supporters are asking mining participants to leave a mining pool called Minexmr as they believe the operation threatens decentralization.

A Single Monero Mining Pool Commands 44% of the Network’s Hashrate, Monero Community Members Debate Issue, Pool Admin Addresses Concerns

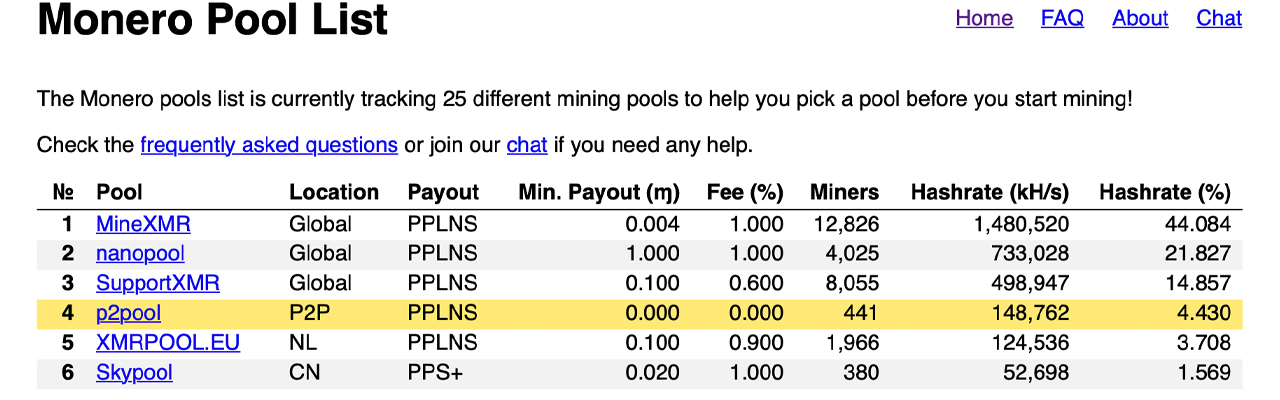

At the time of writing, according to statistics stemming from the web page pools.xmr.wiki, the mining operation Minexmr commands 44.084% of the network hashrate. The hashrate stemming from Minexmr has the Monero community debating on social media and forums and arguing over whether or not it will threaten decentralization.

One person on Twitter explains: “If you are mining monero, and you support this pool, you are also responsible for the centralization of the monero hashrate.”

URGENT: is extremely close to holding the majority of the hashrate; at the time of writing, it’s just under 48%. If you’re mining, make sure that you aren’t using this pool. https://t.co/U0Hz7z2VUv #Monero #XMR

— monero chan (@monerochanXMR) February 14, 2022

On Reddit, the complaints are the same, as one post on the Monero-centric subreddit r/monero asks community members to “boycott Minexmr” and stressed the pool is “too close to 51%.”

Essentially, the Redditor is talking about a 51% attack, which is when a miner controls a majority of the hashpower, and maliciously attacks the network. 51% attacks can equate to major issues like double-spends on the network and deep blockchain reorganizations.

“Why [do] you still join Minexmr.com?” the Redditor asks in the r/monero thread. “There are 30+ other pools and [a] decentralised p2pool. But within [one] day, new miners increased Minexmr.com hashrate from 1.34 to 1.44 GH/s. While total network hashrate is 3.31 GH/s.”

At the time of writing, Minexmr has a dedicated 1,480,520,000 hashes per second or 1.48052 gigahash per second (GH/s) pointed at the XMR network. In addition to those metrics, Nanopool has 21.82% of XMR’s global hashrate and Supportxmr commands 14.85% today.

Between the three XMR mining pools, the combined hash equates to 80.754% of XMR’s global hashrate. Every pool below the top three has a significantly smaller amount of hashpower dedicated to the Monero chain. An admin from the Minexmr team has explained the organization has seen the complaints, and the XMR mining operation plans to increase its pool fees to address the concerns.

“We understand that people are concerned with the large hashrate that Minexmr currently has,” the admin said on Reddit. “We have announced an increase to the pool fees and continue to monitor the situation.”

Mining decentralization has been a big deal among Monero community members. In 2018, when Monero changed its algorithm to stop ASICs from capturing the majority of the hashrate, the XMR network split into four forks.

Monero is currently the largest privacy coin, in terms of market valuation, with a $3.1 billion market cap. During the last two weeks, XMR has increased by 19.3% in value against the U.S. dollar but year-to-date, the privacy-centric crypto monero (XMR) is down 26.3%.

What do you think about the XMR community complaining about centralization concerns with Minexmr capturing 44% of the network’s hashrate? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.