Hut 8 Boasts $60M in 2022 Mining Profit

Nasdaq-listed Canadian mining outfit Hut 8 Mining Corp has reported a 19.6% drop in year-on-year digital asset revenue in 2022 despite mining 28% more Bitcoin (BTC).

The firm, which recently announced a merger with US Bitcoin Corp., recorded roughly $32 million less in digital asset revenue despite mining 782 more Bitcoin, due in part to declining Bitcoin prices at the start of 2022 following the 2021 bull run.

Hut 8 Boosts Hashrate Capacity to 2.5 EH/s

Hut 8 mined more BTC by the end of 2022 because it bought 21,455 MicroBT M30S mining computers. These machines increased Hut 8’s installed hashrate to 2,5 EH/s, 2.5% higher than in December 2021.

Cryptocurrency miners use purpose-built equipment to vary a special number called a nonce in a Bitcoin transaction block header. The goal of adjusting the nonce is to generate a number less than the block’s hash and earn a Bitcoin block reward and fees paid by those whose transactions are contained in the transaction block.

The Bitcoin algorithm makes it more difficult to guess the correct hash value as more mining equipment joins the network.

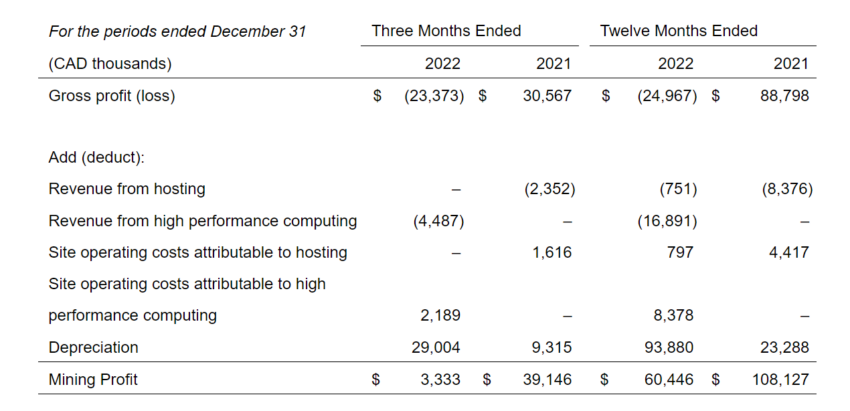

At the 2022 year-end, the firm placed at least 9,086 mined Bitcoin into custody. It earned $60.4 million in so-called Mining Profit, compared with $108 million in 2021.

Mining profit is mining revenue without considering depreciation and direct overheads.

Merger With US Bitcoin Corp

Last year saw the consolidation of the Bitcoin mining industry, with several firms, including Iris Energy, Greenidge Generation Holdings, and Argo Blockchain, struggling to service debt.

Boards from Hut 8 and US Bitcoin Corp recently confirmed a $990 million merger to leverage the former’s operational model with the latter’s data centers.

The merger will focus on sustainable operations already championed by both firms. US Bitcoin Corp draws electricity behind the meter at multiple renewable energy sites across the U.S.

The new company will be called Hut 8 Corp and boast 5.6 EH/s of mining power, spread across five sites in Canada, New York, and Texas.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Sponsored

Sponsored

Disclaimer

BeInCrypto has reached out to company or individual involved in the story to get an official statement about the recent developments, but it has yet to hear back.