Filecoin (FIL) Price Falls, Investors Brace for Further Decline

Filecoin’s (FIL) price had been forming lower lows for the better half of this month, finally halting the decline in the past week.

While investors tend to hold out hope for recovery of the asset they are invested in, FIL may not be seeing that.

Filecoin Investors Step Back

The consistent drawdown in Filecoin’s price has resulted in $20 million worth of long liquidations since the beginning of June. This significant loss has created a bearish ripple effect throughout the market.

As a result of these liquidations, many optimistic investors have been spooked and are pulling back. Open Interest has declined by 28% within eight days. The sudden shift in sentiment underscores the fragility of confidence in volatile markets like cryptocurrencies.

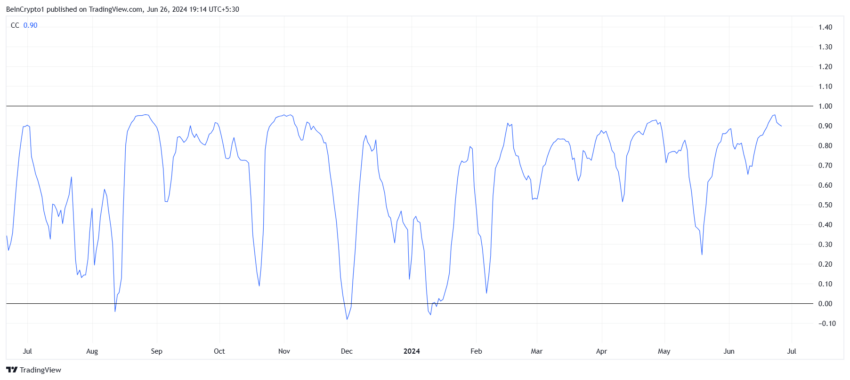

Another one of the drawbacks of Filecoin is its high correlation of 0.90 with Bitcoin. This correlation means that when Bitcoin experiences downturns, Filecoin is likely to follow suit, amplifying the challenges for FIL investors.

With Bitcoin in a bearish phase, Filecoin’s high correlation with BTC is proving to be a disadvantage. Investors are now more cautious, given the potential for further declines influenced by Bitcoin’s performance.

Read More: Filecoin Staking: How To Get Started

FIL Price Prediction: Taking It Slow

Filecoin’s price will encounter considerable resistance while attempting a recovery, with the altcoin changing hands at $4.3. If FIL can breach the resistance at $4.6, it could have a shot at reclaiming $5.0 as support, pushing it further upwards towards $5.6.

This price marks a critical resistance above which FIL could rally.

Read More: Filecoin (FIL) price prediction 2024/2025/2030

However, failure to breach $5.6 could result in consolidation above $4.6. On the other hand, if the altcoin happens to face bearish conditions, a drawdown below $4.2 is likely, which would completely invalidate the bullish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.