Coinbase terminates Japan operations, why is share price still up 50% in two weeks?

Key Takeaways

Coinbase is halting all operations in Japan, citing “market conditions”

Last week it cut 20% of its workforce, having already cut 18% last June

Stock price is up nearly 50% on the year amid crypto rally, but is still 85% off its peak

Problems are aplenty at the company, while CEO Armstrong sold 2% of his stake in October

Coinbase has been in a world of pain recently.

Just last week, the exchange announced it was laying off 20% of its workforce, having already cut 18% last June. I wrote a piece analysing what this meant for the company, which was trading at a market cap below $10 billion, 90% down from the price at which it went public in April 2021.

This came after CEO Brian Armstrong unloaded 2% of his stake in the company in October, after which I wrote a deep dive analysing what it all meant for a company that has been viewed as the torch-bearer to carry crypto into mainstream circles once and for all following its high-profile floating on the Nasdaq.

But today, more bad news came. The exchange announced it is halting all operations in Japan, citing “market conditions”.

Coinbase stock price on the up

Despite the onslaught of bad news, Coinbase’s share price has been a big winner in the early weeks of 2023, up 48% in just 18 days.

This comes amid the biggest crypto rally in 9 months, which has seen prices surge across the board. While the bounceback in Coinbase’s share price is great news for investors, it also ironically sums up exactly what the problem is – Coinbase’s correlation to the crypto market.

There are few things more volatile than crypto, so it is not good news to be tied at the hip to its price action. But Coinbase’s performance is dependent on the crypto market because as the price falls, transaction volumes and interest in the industry, and by extension Coinbase, plummets.

During the pandemic, this was a great thing. The money printer was on maximum power, interest rates were low and retail investors were all aboard the FOMO train, armed with a healthy curiosity about crypto and a fat stimulus cheque.

But with the changing macro environment, the crypto industry has freefallen from $3 trillion to $800 billion, before this recent surge popped it back above $1 trillion.

Why are Japanese operations ceasing?

Despite the pleasant pump this past few weeks, zooming out tells you that Coinbase has shed 85% of its value since going public, gone through two rounds of layoffs, seen its CEO sell 2% of his stock in October and now is ceasing operations in Japan.

All Japanese Coinbase customers will have until February 16th to withdraw their holdings from the platform. If they fail to do so, the remaining assets will be converted to Japanese yen. Coinbase had worked hard during the previous crypto winter to expand into the Japanese market, so the abrupt departure is a shame.

But Coinbase is not the only exchange to make this move, with rival Kraken also announcing it was ceasing Japanese operations last month. Also like Coinbase, Kraken had cut a large chunk of its workforce, laying off 30% of employees after the FTX collapse shook the market. The plight of Coinbase’s extreme correlation with the crypto market is once facing exchanges across the industry.

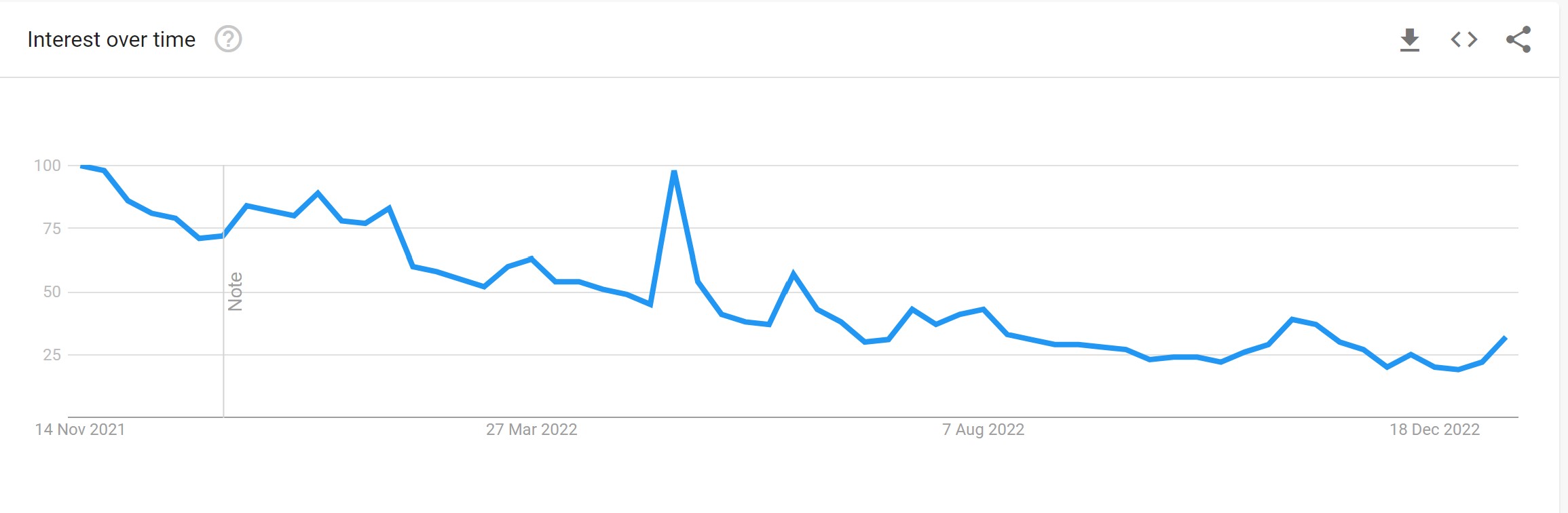

Coinbase Q3 results revealed that transaction volume fell 44% from Q2. The fall in volume and interest ultimately is what has caused the plummeting share price, layoffs, and now ceasing of Japanese operations, with a glance at Google Trends all you need to see the scale of the dropoff in the public’s attention to the exchange.

For $COIN investors, they will hope that the last few weeks of softer macro data and a crypto bounceback are an omen of things to come, otherwise this share price rally will be short-lived.

For $COIN investors, they will hope that the last few weeks of softer macro data and a crypto bounceback are an omen of things to come, otherwise this share price rally will be short-lived.