BTC/USD Breaches $34,000 Resistance as Bitcoin Retakes Lost Ground

Bitcoin (BTC) In a Decisive Move As Bitcoin Retakes Lost Ground– July 24, 2021

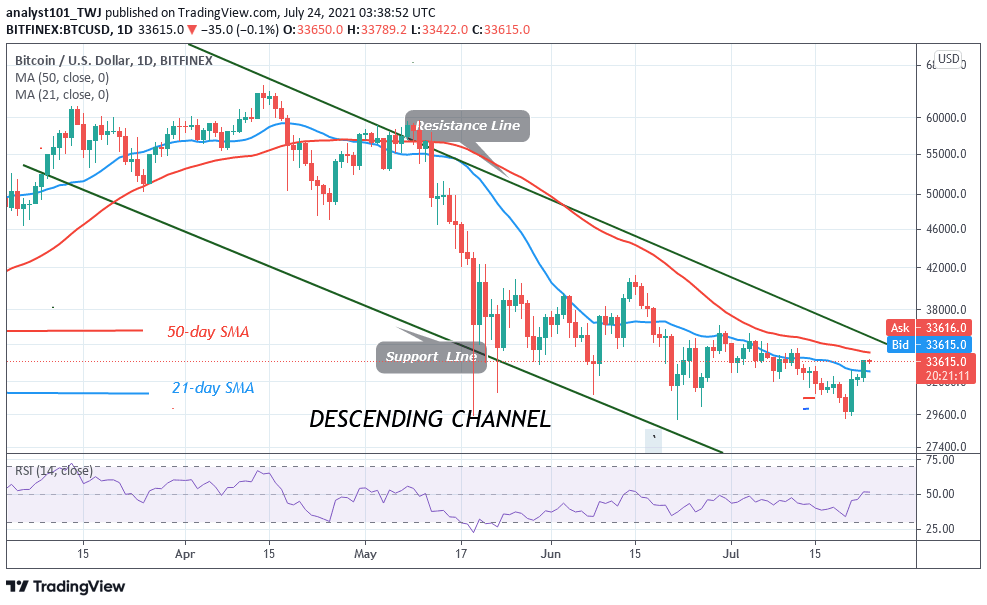

BTC/USD has continued to make positive moves as Bitcoin retakes lost ground. However, the subsequent bullish move is doubtful as the market reached the overbought region of the market. Incidentally, the $34,400 to $35,000 resistance zones will poise as a battleground for the bears and the bulls. Sellers are likely to be attracted in the resistance zone which will be an uphill task for buyers.

Resistance Levels: $45,000, $46,000, $47,000Support Levels: $35,000, $34,000, $33,000

Bitcoin’s (BTC) price rebounded and it is approaching the high of $34,000. On July 20, BTC’s price consolidated above the $29,400 support as bulls bought the dips. This propels the king coin to have a strong rebound as it reached the high of $34,076. For the past 24 hours, the bulls have been battling to penetrate the $34,000 and $35,000 resistance zones. The bears have been having selling pressure above the $34,000 resistance zone. On the upside, if buyers overcome the resistance zone, BTC/USD will rally to $37,000 high. On the other hand, if buyers fail to breach the resistance zones, the BTC price will fall. In addition, the bears will sink the crypto to the previous low at $29,400. Later, Bitcoin will further decline to $28,000 if the previous low is breached. Bitcoin is above the 80% range of the daily stochastic. It indicates that the market has reached the overbought region. There is a possibility of downward movement of prices.

Bitcoin Security Worries Some Institutional Investors

Some Institutional investors coming for the first are hindered from buying crypto because of the security of cryptocurrency custodial services. A survey has been carried out by the United Kingdom-based crypto fund, Nickel Digital Asset Management. The survey includes respondents from the United States, France, Germany, the United Arab Emirates, and the United Kingdom, who collectively own $275 billion in assets under management. An investigation of 100 wealth managers and global institutional investors is conducted to find out the biggest investor associated with crypto. The survey is conducted online from May to June 2021. The investigation found low confidence among institutional investors in crypto security, with 76% of respondents citing concerns about the security of custodial services as one factor stopping them from investing in crypto. Other concerns include the regulatory environment as a major obstacle. The respondents complained of a lack of transparency and volatility. The survey includes a lack of reputable fund managers offering crypto investment.

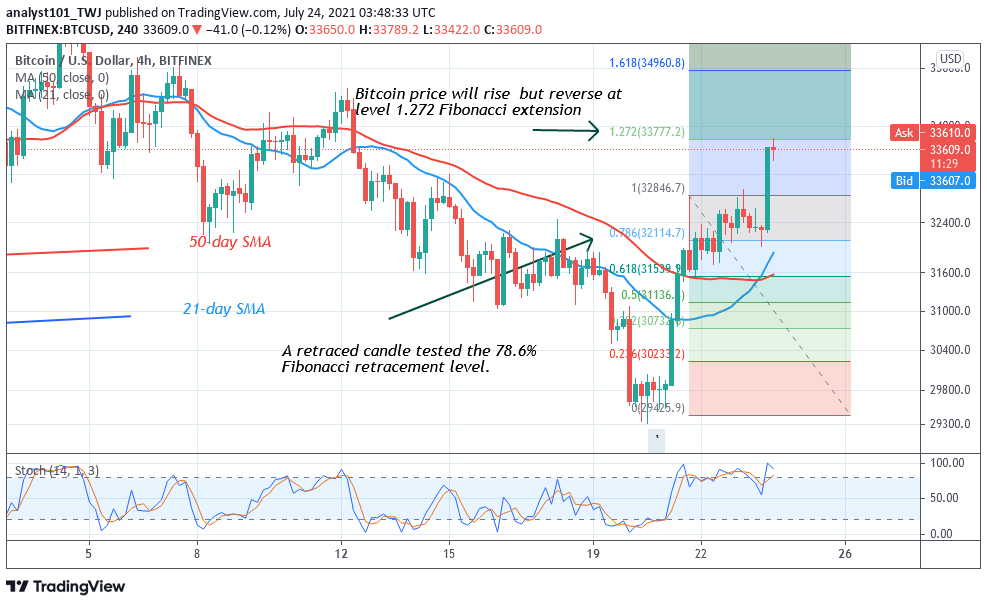

Bitcoin price is attempting to break the $34,000 high as Bitcoin retakes lost ground. The crypto is consolidating below the resistance with small body indecisive candlesticks. BTC price is retesting the resistance to break. Meanwhile, on July 21 uptrend; a retraced candle body tested the 78.6% Fibonacci retracement level. The retracement indicates that Bitcoin will rise but reverse at level 1.272 Fibonacci extension or level $33,777.20. Bitcoin will reverse to the 78.6% Fibonacci retracement level where it originated.

Looking to buy or trade Bitcoin (BTC) now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider