BlackRock’s BUIDL fund becomes first $500M tokenized fund

Key Takeaways

BlackRock’s BUIDL fund is the first tokenized treasury to reach a $500 million market cap.

Ethereum dominates the tokenized treasury market with over 75% share.

Share this article

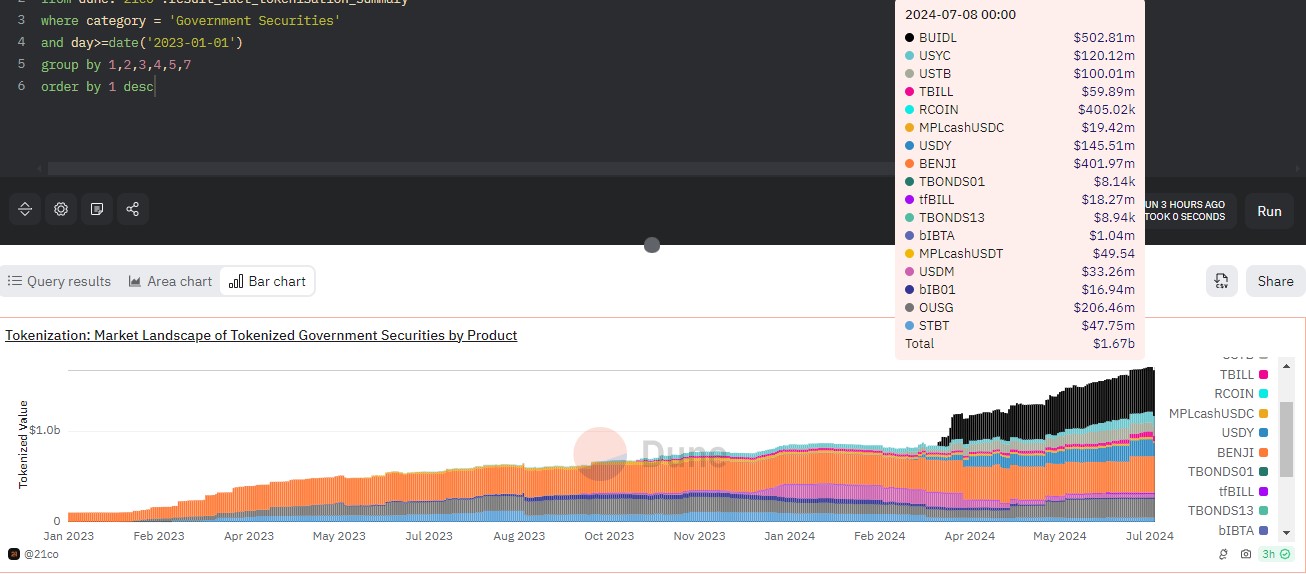

BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) has surpassed $500 million in market value, according to data from Dune Analytics. The growth also made BUIDL the first tokenized fund to hit the $500 milestone.

As of July 8, BUIDL has attracted around $502 million in deposits. Data from Etherscan shows that the latest achievement comes as Ondo Finance increased its holdings in BUIDL.

Ondo’s OUSG is the largest holder with $173.7 million, followed by Mountain Protocol, which uses BUIDL to back its USDM stablecoin, as reported by Crypto Briefing.

Meanwhile, Franklin Templeton’s Franklin OnChain US Government Money Fund, represented by the BENJI token, has captured around $402 of deposits.

BlackRock’s BUIDL remains dominant in the tokenized government securities market. Launched in late March this year, the fund surpassed Franklin’s FOBXX to become the world’s largest tokenized treasury fund within six weeks.

The total market for tokenized treasury funds now stands at $1.67 billion, with Ethereum leading the space, Dune Analytics data shows.

The real-world asset (RWA) market is on the rise. According to data aggregator Artemis, RWA tokens grew almost 28% on average during the second quarter, outperforming other crypto sectors. Remarkable names include Ondo (ONDO), Mantra (OM), Clearpool (CPOOL), and Maple (MPL).

Share this article