Bitcoin’s Network Activity Is Soaring. What Comes Next?

Key Takeaways

Bitcoin has risen by nearly 13% over the past week.

A spike in network growth and open interest point to further gains.

Breaching the $42,100 resistance level would validate the optimistic outlook.

Share this article

Several on-chain metrics suggest that Bitcoin is gaining strength for a significant bullish impulse. Still, the top crypto has a big hurdle to overcome first.

Bitcoin On-Chain Metrics Pick Up

Bitcoin looks like it’s gaining strength again.

The leading cryptocurrency has enjoyed an impressive uptrend over the past week. It’s gained nearly 5,000 points in market value, rising from a low of $37,600 on Mar. 14 to a high of $42,400 on Mar. 19.

Although prices have retraced by roughly 5% in the last 48 hours, Bitcoin’s uptrend appears to be gaining strength.

The number of new addresses joining the Bitcoin network has significantly increased since Feb. 21, making a series of higher highs and higher lows. The uptrend in this on-chain metric suggests growing interest from sidelined investors who appear to be re-entering the market.

More than 480,000 Bitcoin addresses were created in Mar. 17 alone, which is a strong positive signal for further upward price action.

Network growth is often considered one of the most accurate price predictors for cryptocurrencies. A steady uptrend in the number of new addresses created on a given blockchain often leads to rising prices over time.

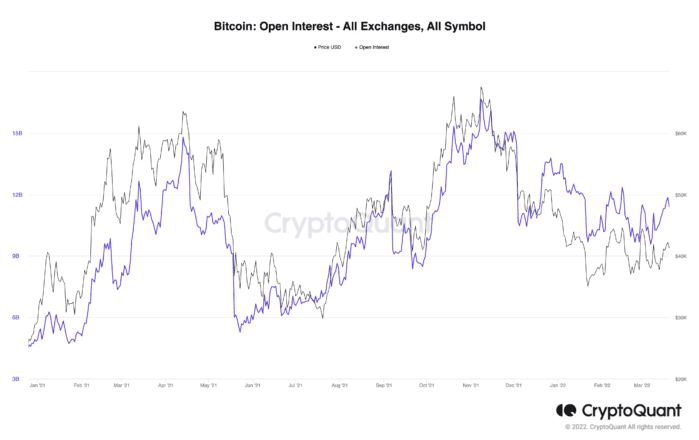

A similar uptrend can be seen in the futures markets, where the number of open positions, including both long and short positions, has been steadily rising since Mar. 7. As open interest increases, it indicates more liquidity, volatility, and attention is coming into the derivatives markets. A continuous increase in open interest to surpass 12.36 million could support Bitcoin’s recent price increase.

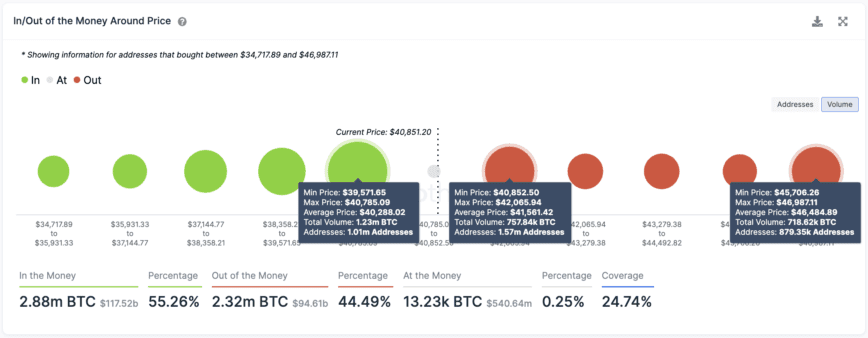

Still, transaction history shows that Bitcoin has one substantial resistance wall to break to be able to advance further.

IntoTheBlock’s In/Out of the Money Around Price model reveals that 1.57 million addresses have previously purchased nearly 760,000 BTC between $40,900 and $42,100. A decisive daily candlestick close above this hurdle could give Bitcoin the strength to break the next critical barrier, which is sitting at $46,500.

The IOMAP also shows that the top-ranked cryptocurrency is holding above stable support as over 1 million addresses have previously purchased 1.23 million BTC at an average price of $40,300. As long as Bitcoin remains trading above this foothold, it has a chance at advancing further. However, failing to do so could result in a downswing to $37,500.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Is Time on our Side? The Case for Bitcoin’s Lengthening Cycles

One of the many unique features of BTC is its halving process, which is often accompanied by a bullish movement and preceded by bearish consolidation. Bitcoin’s halving events have been…

Ukraine Signs Virtual Assets Bill to Legalize Bitcoin

The update comes after cryptocurrency donations to Ukraine’s war efforts have broken $100 million. Ukraine Signs Crypto Bill Into Law Ukraine just legalized crypto. The Ukrainian Government’s Ministry of Digital…

Bitcoin Showing Little Sign of Significant Resistance Ahead

Bitcoin appears to be preparing for a bullish impulse as on-chain metrics show signs of increasing demand and little to no resistance ahead. Bitcoin Has the Potential to Surge Bitcoin…

Wasabi’s Bitcoin Mixer to Start Censoring Transactions

Wasabi, a Bitcoin-only wallet with one of the most popular transaction mixing implementations, has announced that it will start censoring certain transactions to its CoinJoin mixer. Wasabi’s CoinJoin to Start…