Bitcoin ETF Launch Hype Fades as Funds Slip in Value, BTC Futures Open Interest Down 38% in 2 Months – Finance Bitcoin News

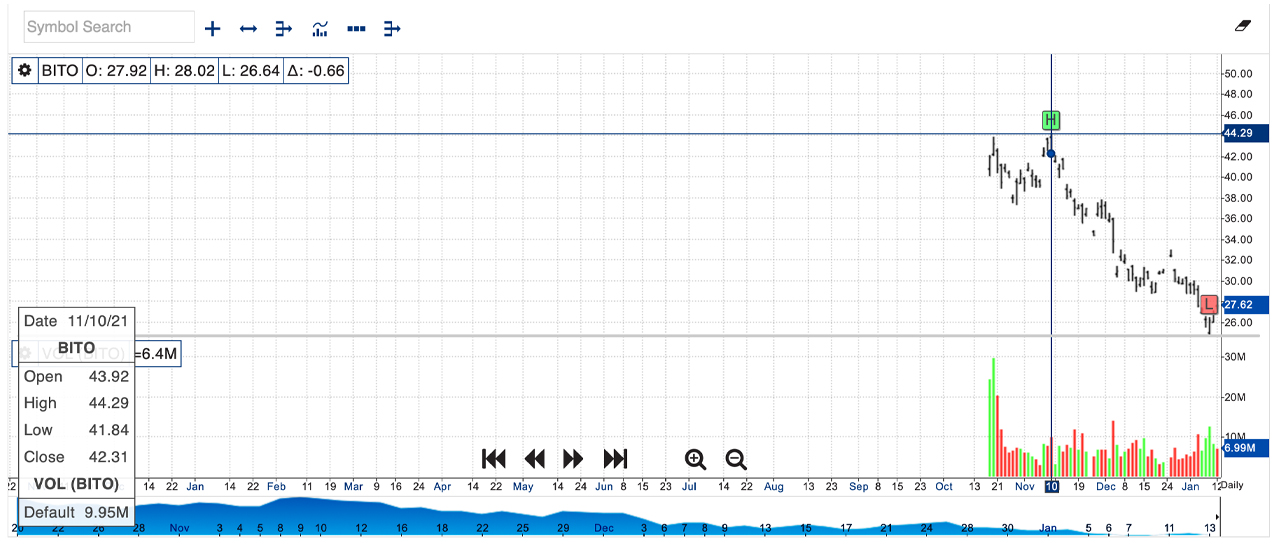

Following the charged-up debut of the Proshares bitcoin exchange-traded fund (ETF), Valkyrie’s bitcoin futures ETF and the Vaneck bitcoin strategy ETF, interest in these types of funds seems to have faded a great deal. After the Proshares bitcoin ETF BITO reached an all-time high on November 10, the ETF is down 39% over the last 64 days. Valkyrie’s bitcoin ETF has also shed 37% in value over the last two months.

Bitcoin Futures ETF Lull Continues

A large portion of the cryptocurrency community was very hyped up for years about the launch of the first bitcoin exchange-traded fund (ETF), as a number of bitcoin ETF applications were denied prior to 2021.

Finally, when the first U.S. bitcoin futures ETF was approved, the debut of Proshare’s bitcoin futures ETF smashed records, capturing close to $1 billion in total volume during the first 24 hours. Months later, the Proshares Bitcoin Strategy ETF (BITO) is exchanging hands for $26.96 on January 13, 2022, but that price is 39.12% lower than the 44.29 high on November 10, 2021.

Bloomberg author Katherine Greifeld explained in mid-November that the “bitcoin futures ETF frenzy is fading.” “While the Proshares fund absorbed $1.1 billion in just two days — the quickest an ETF has ever done so — that pace of growth has cooled considerably,” Greifeld said at the time.

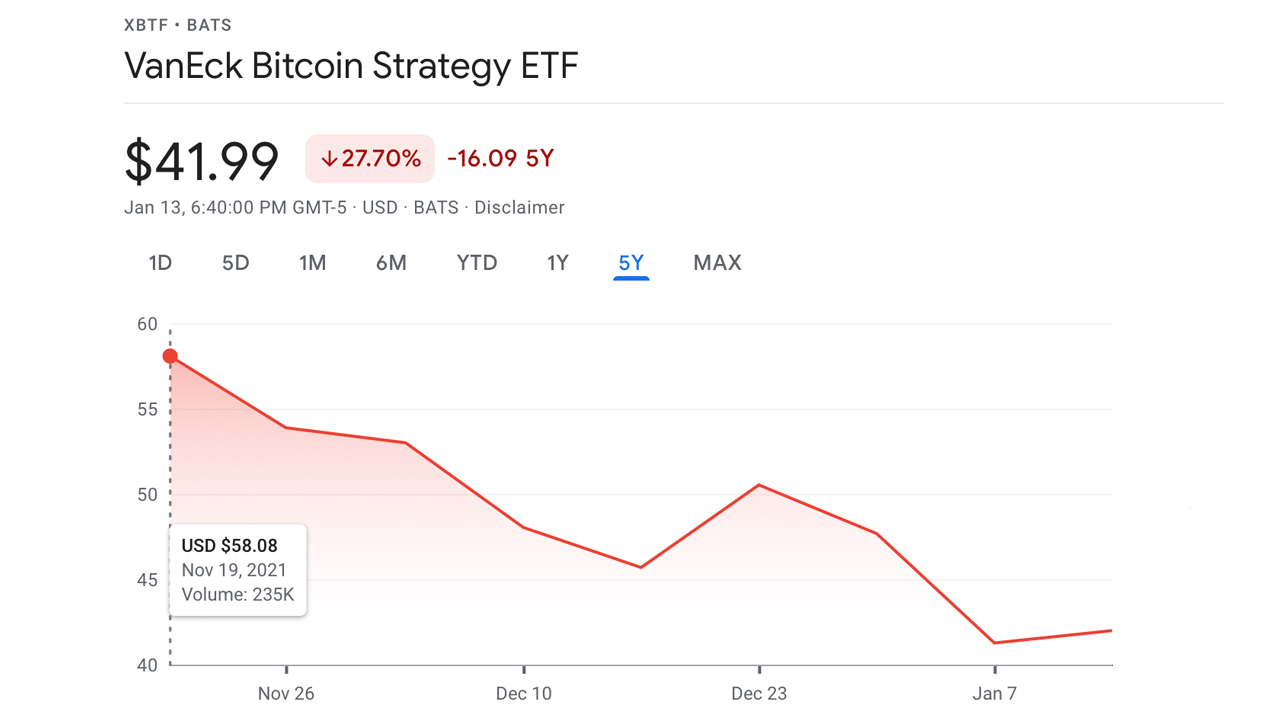

The financial author further discussed the Vaneck ETF, as she noted that lower management fees could differentiate the fund from the rest. At the time, Greifeld quoted Bloomberg Intelligence senior ETF analyst, Eric Balchunas, who said:

There’s definitely a lull going on right now relative to the launch mania and so Vaneck has their work cut out for them in trying to get people excited again.

Valkyrie’s BTF Down 37%, Vaneck’s XBTF Is Down 27%, Aggregate Bitcoin Futures Open Interest Across Cryptocurrency Exchanges Slid by More Than 38%

The same can be said for the Valkyrie Bitcoin Strategy ETF (BTF) when it reached an all-time high (ATH) of $26.67 per share on November 9, 2021, and today it’s changing hands for $16.70 per unit or 37.38% down from the ATH.

The Vaneck Bitcoin Strategy ETF (XBTF) is only down 27.70%, as the ETF exchanged hands for $58.08 per unit on November 19, 2021, and today it’s trading for 41.99 per unit. While Proshares and the Valkyrie ETFs debuted well before Vaneck’s offering, all of the funds have a strong relationship with spot price of bitcoin and the crypto asset’s futures markets.

Futures markets have seen a decline in open interest, as total bitcoin futures open interest across cryptocurrency exchanges has declined since mid-November as well. The highest number of bitcoin futures open interest was on November 11, 2021, with over $28 billion.

Today, the aggregate open interest across the most popular derivatives exchanges is $17.22 billion. That equates to a loss of 38.50% over the last two months and the pattern is quite similar to bitcoin’s (BTC) spot market price action.

What do you think about the three bitcoin futures ETFs and their overall performance during the last few months? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Google, NYSE, Nasdaq,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.