Bitcoin Centralized? Michael Saylor Owns 1 in Every 150,000 BTC

The scale and implications of MicroStrategy’s recent Bitcoin (BTC) acquisitions have sparked vigorous debates in traditional financial and cryptocurrency circles.

The key question is, is Bitcoin becoming centralized due to these massive buys?

MicroStrategy Is Banking the Most on Bitcoin

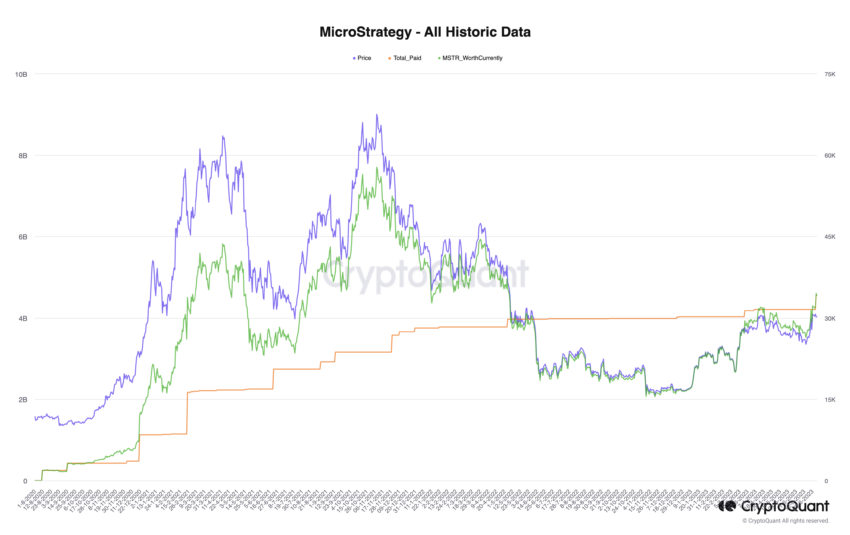

MicroStrategy, the business software company led by Michael Saylor, has, since August 2020, adopted an unorthodox balance sheet strategy. It has replaced traditional cash reserves with Bitcoin.

Its recent purchase of 12,333 BTC, at an average price of $28,136 per coin, reaffirms the firm’s bullish stance on crypto. The company’s Bitcoin war chest now totals an impressive 152,333 BTC, acquired at an average price of $29,668.

This fervent Bitcoin buying spree has positioned MicroStrategy as one of the world’s largest institutional Bitcoin holders.

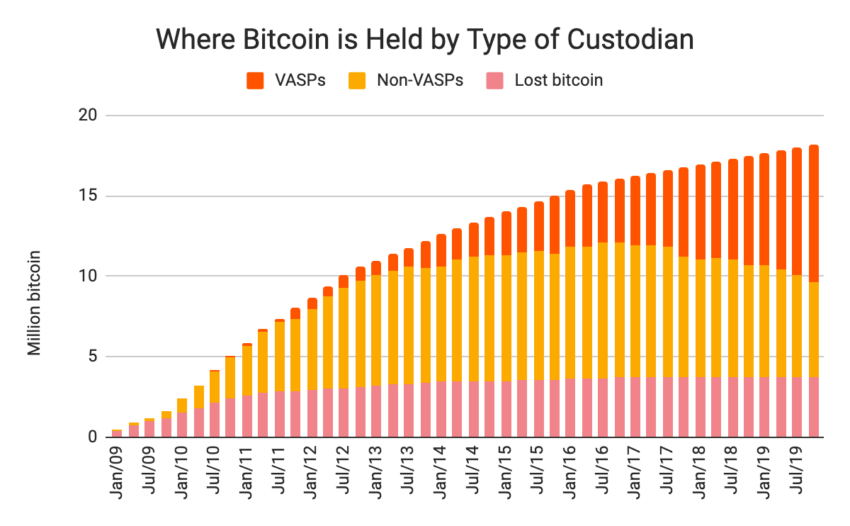

Saylor’s Bitcoin balance now represents approximately 0.81% of the available Bitcoin supply. This assumes about 3.7 million BTC are irrecoverable, per a Chainalysis study.

This concentration level raises questions about the potential centralization of a currency prized for its decentralized nature.

Michael Saylor’s Impact on Bitcoin’s Price

MicroStrategy’s Bitcoin investment strategy, conceived as a defense against inflation and currency debasement, seems to revolve around an “energy currency” paradigm.

This concept, originally proposed by American industrial titan Henry Ford in 1921, implies the backing of currency with “units of power,” creating a new monetary standard. Ford’s vision was of a currency standard resilient against the control of any “international banking group.”

This aspiration resonates with the philosophy of Bitcoin, which is why Saylor remains optimistic about Bitcoin’s long-term value proposition.

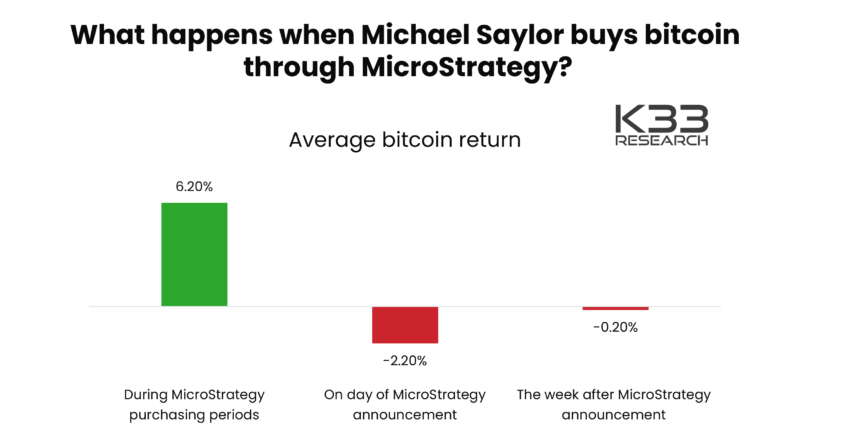

The question, however, is whether Saylor’s steadfast conviction and substantial Bitcoin accumulation potentially alter the intrinsic decentralized nature of the cryptocurrency. Especially when the recent announcements have proven to affect Bitcoin’s price.

“MicroStrategy BTC purchase announcements tend to be followed by short-term negative price action in BTC, as the market absorbs the fact that certain buy-side liquidity has left the market,” said Vetle Lunde, research analyst at K33.

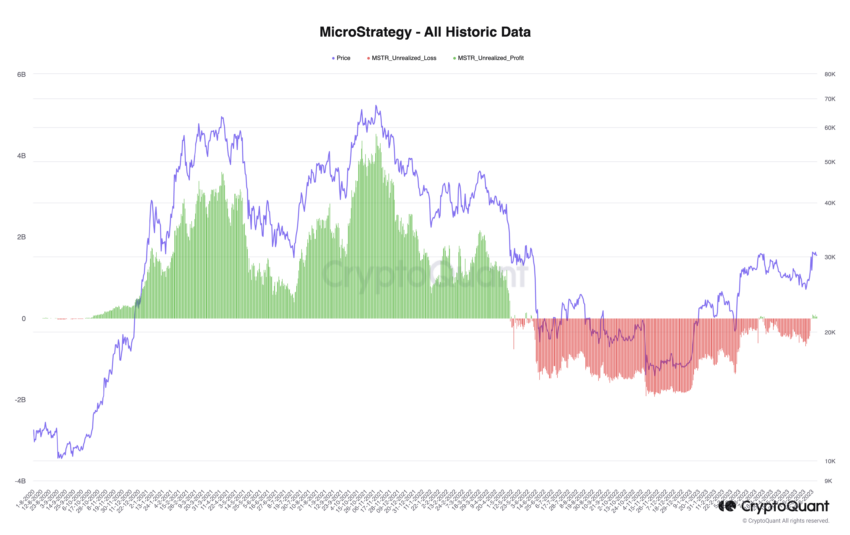

Indeed, the confluence of Saylor’s unabating purchases and his unswerving advocacy for Bitcoin influences market dynamics. The sheer scale of MicroStrategy’s holdings could have even more severe implications on Bitcoin’s price if the firm ever fails to withstand the volatile nature of this cryptocurrency.

“[MicroStrategy] is valued almost entirely as a Bitcoin holding company. So if, for some reason, like a liquidity crisis during a recession, Bitcoin’s price dipped very low, the company would end up being valued at nothing… If [MicroStrategy] ever goes bankrupt the Bitcoin holdings will be liquidated. That could have a big impact on Bitcoin’s price,” said an important crypto community member.

Moreover, some argue that such accumulation of Bitcoin in a few hands contradicts its original design as a decentralized and democratized digital asset. Critics question whether the risks of centralization offset the potential benefits of Bitcoin’s “energy currency” paradigm.

Popular crypto enthusiast Hodlnaut warns that following the upcoming halving, MicroStrategy’s Bitcoin holdings will be equivalent to the total block subsidies accumulated over an entire year.

But for those whole believe the firm is becoming a “too big” BTC holder, Henry Brade, co-founder of CoinMotion, suggests:

“Stop selling your Bitcoin to them. It is the most valuable asset the world has ever seen. Treat it accordingly.”

A Growing Trend: BTC as a Hedge

Michael Saylor’s vision of Bitcoin as an effective hedge against inflation is increasingly gaining acceptance. MicroStrategy Bitcoin buying spree represents a bold shift in traditional companies’ approach to cryptocurrencies, a move some see as pioneering and others as impulsive.

Ultimately, the impact of Saylor’s massive Bitcoin buying spree on Bitcoin’s potential centralization remains a contentious topic.

While there are concerns, Bitcoin’s decentralized infrastructure remains intact. One company’s significant holdings do not alter the underlying protocol that ensures Bitcoin’s decentralization.

Although Saylor and MicroStrategy now hold an undeniably large portion of the cryptocurrency, Bitcoin remains fundamentally decentralized.

Yet, as more companies potentially follow MicroStrategy’s lead, the discourse around Bitcoin’s centralization will likely remain an important and evolving conversation within the cryptocurrency market. This dialogue could be critical in shaping regulatory norms, public perception, and the future trajectory of Bitcoin.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content.