The Growing Defi Market on Bitcoin: What’s Yielding Already?

The burgeoning decentralized finance (DeFi) market is evolving beyond Ethereum (ETH) and onto other chains. What may be surprising to hear for some: Bitcoin (BTC) is one of them.

Read on the learn more about the growing Bitcoin DeFi ecosystem and what kind of yields you can expect to earn on your BTC holdings.

DeFi on Bitcoin

Powered by Bitcoin Layer 2 (L2) smart contract protocols, such as RootStock (RSK) or Stacks, and secured by Bitcoin, Bitcoin-native DeFi apps are emerging with the aim to provide next-generation financial services built on Bitcoin.

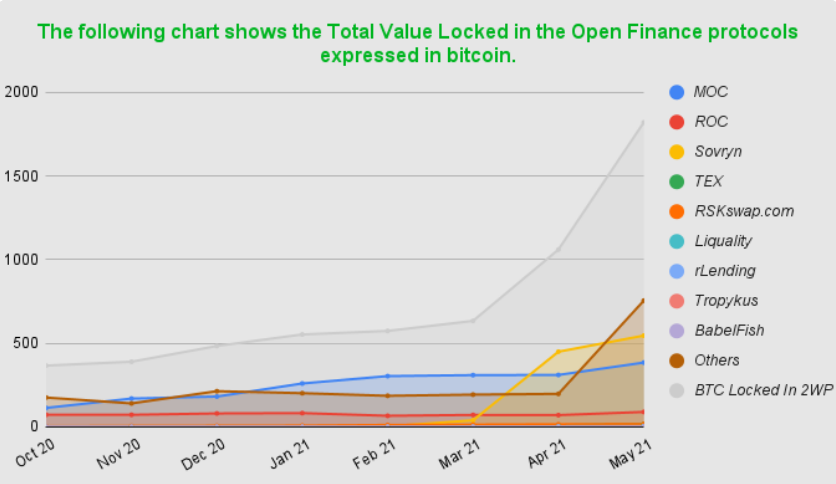

While the Bitcoin-native DeFi market is still small compared to what’s available on Ethereum, Binance Smart Chain, and other popular DeFi destinations, the market for decentralized Bitcoin-native yielding products is on the rise.

Currently, the most popular use cases in the Bitcoin DeFi market include lending, trading, staking, and stablecoins.

Bitcoin-native DeFi apps to check out

Let’s dive in and look at some of the leading Bitcoin DeFi platforms and what decentralized products and services they currently offer.

Sovryn

Sovryn is a decentralized bitcoin trading and lending platform. Sovryn is a non-custodial, permissionless protocol that utilizes smart contracts for BTC borrowing, lending, yield farming, and margin trading.

Sovryn is built on top of RSK and has a number of advantages over tokenized BTC on Ethereum, such as better storage handling and data structure, and lower transaction fees.

You can use Sovryn to earn interest by lending BTC to borrowers and margin traders. Moreover, you can also trade bitcoin with USD stablecoins. Other features you can access on Sovryn include automated market maker (AMM) pools and yield farming.

Money on Chain

Money on Chain offers a bitcoin-collateralized stablecoin, an interest-bearing digital asset for BTC token holders, and a decentralized leverage exchange.

Money on Chain seeks to solve the problem of bitcoin volatility and reduce the counterparty risks found in other stablecoins, such as the use of traditional bank accounts or less developed decentralized networks.

To this end, Money On Chain uses BTC as collateral for the stablecoin. The collateral is not held in some third-party bank account but secured by the RSK smart contracts, which provides a token pegged 1:1 to BTC.

Money On Chain is based on four tokens including Dollar on Chain (DOC), a USD price pegged stablecoin token, the BitPro token (BPro), a token meant for bitcoin holders to earn interest on BTC and gain free leverage, and the BTCx, a which represents a leveraged long bitcoin position. The protocol also provides a Money on Chain (MOC) token, which is the platform’s governance token.

Atomic Finance

Atomic Finance allows bitcoin holders to generate yield on their BTC while retaining custody through a covered call strategy fueled by DLCs (Discreet Log Contracts). A covered call entails holding a token and simultaneously selling a call position on the token, with the option premium being your generated yield.

Discreet Log Contracts allow for non-custodial speculation directly on top of the Bitcoin network. By combining Bitcoin’s security with more flexible smart contracts, the protocol provides non-custodial yields through financial derivatives like call and put options.

The protocol is currently in beta with further updates to be released in the future.

AlexGo

AlexGo is an open-source decentralized finance protocol built on Bitcoin operating on the Stacks blockchain. Stacks connects to Bitcoin, allowing smart contracts and digital assets that leverage Bitcoin’s security, capital, and network capabilities.

You should be able to use AlexGo to borrow bitcoin at flexible rates, lend your bitcoin to earn interest, maximize your profits with BTC long positions and manage your risk with BTC short positions.

It’s important to note that AlexGo is still working on their testnet.

DeFiChain

DeFiChain is a decentralized protocol that offers financial services, powered by the Bitcoin network. The protocol relies on a hybrid proof-of-stake (PoS)/proof-of-work (PoW) mechanism and is anchored to the Bitcoin blockchain through Merkle root, giving it an added layer of security.

Furthermore, using the platform’s native token DFI, you can borrow and lend through collateralized systems, wrap tokens, tokenize assets, swap on their decentralized exchange, and more.

At the time of writing, DeFiChain had over USD 800m locked in its smart contracts.

Tropykus Finance

Tropykus Finance is a decentralized finance protocol that seeks to connect BTC investors to DeFi opportunities in emerging markets, such as Latin America.

The protocol leverages RSK smart contracts to offer decentralized lending and credit products that you can earn interest from.

Other Bitcoin-native DeFi apps you can check out include Defiant and rLending.

What are the yields like in Bitcoin DeFi?

At a time when traditional lenders are offering historically low interest rates, bitcoin hodlers can earn above-average yields on both CeFi (centralized finance) and DeFi lending platforms.

For instance, on the lower end of the yield range, Gemini Earn allows you to earn up to 1.49% APY (annual percentage yield) on your BTC. On the other hand, BlockFi offers up to 5% APY on bitcoin deposits on the platform.

As far as Bitcoin DeFi is concerned here are some projected yields, taken from the dapps’ websites at the time of writing.

Tropykus Finance

4.00% APR (Annual Percentage Rate) on rBTC microsavings7.64% APR on DOC token2.16% APR on RIF token

Sovryn

4.55% APY on rBTC158.61% APY on SOV/rBTC AMM202.52% APY on XUSD/RBTC AMM

Money on Chain

28.50% APR BPro Token historical performance13.73% on MoC staking

Securing decentralized finance protocols with Bitcoin may provide a more robust DeFi landscape, which has long been plagued by insecure infrastructure.

Whether the largely Ethereum-loving “DeFi degens” will move over to Bitcoin, however, remains to be seen. Perhaps if the yields will make it worthwhile. ____Learn more: – Narratives Blur as Bitcoin and Ethereum Target Each Other’s Field

– Multi-Chain Future Brings Multiple Competitors to Bitcoin & Ethereum – Analysts

– NFTs ‘on Bitcoin’: Yes, That’s a Thing!- WBTC: Where Bitcoin Meets DeFi

– Bitcoin and Ethereum Can Coexist With DeFi Bridging the Two- DeFi On Bitcoin To Grow In The Shadow Of Ethereum