TruePNL Launchpad Review: Why Is It Undervalued?

Striving to improve the level of inclusivity when working with digital assets, the TruePNL team has launched several products, such as Launchpad and Robo-trading marketplace, scrupulously designed to raise the profitability of trading and investing.

After the general market decline, TruePNL turned out to be majorly undervalued compared to its competitors.

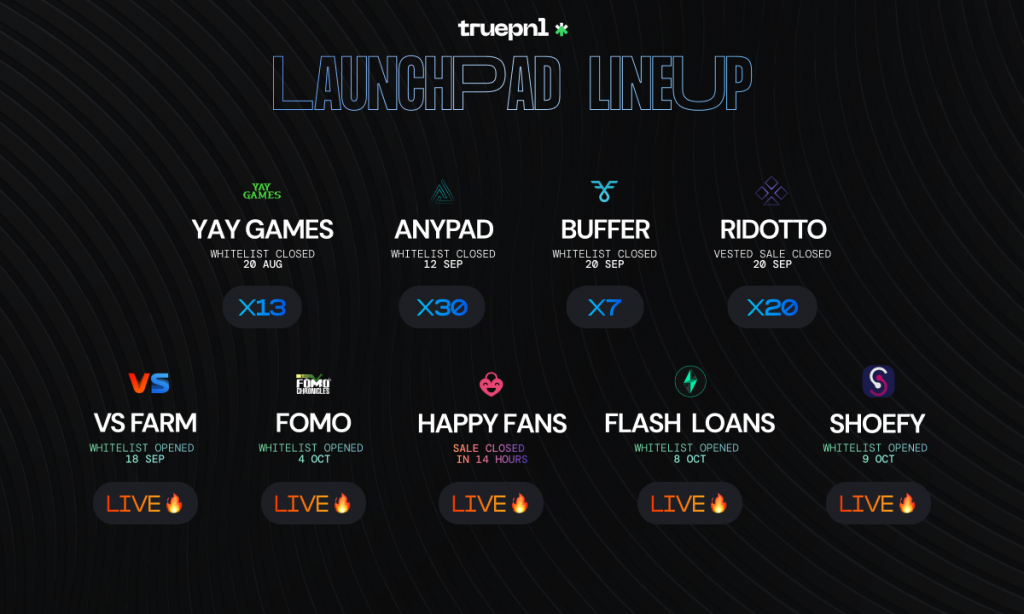

However, focused on the maximum performance of the products it develops, the company already boasts several successful Launchpad cases with impressive 30x and 20x returns.

Success cases in numbers

As of now, the TruePNL Launchpad has held 5 IDOs with a $250 average check, with the latest vested sale of HappyFans closing in only 14 hours since the launch! The next IDOs are in progress right now.

Here’s some more statistics:

Anypad $APAD all-time high is $0.1 (x30 from the sale price), the current price is $0.04 (x8);YayGames $YAY ATH 0.15 (x13), current $0.04 (x3-x4);Buffer $iBFR ATH is $0.36 (x7), current $0.08 (x1.5);Ridotto $RDT ATH is $0.85 (x20) current $0.5 (x9).

Investments paid off almost immediately, and investors managed to gain profit on top of that. Currently, they are still gaining token profits that can be held as a long-term investment or sold.

In order to take part in the allocation, $PNL – a native token of the platform is being used. Investors use $PNL for obtaining allocations in all projects launching on TruePNL.

In theory, a minimal $50 – $100 worth of $PNL purchased a month prior could have provided investors with a hefty allocation.

When holding $400 to $1000, an investor can obtain a maximum allocation on a regular basis. And if you buy $1000 worth of tokens and hold them for two or three weeks, you’ll get an allocation in one project.

Here’s how the math works on YAY Games and Anypad sales examples: a user holds $1,200 worth of tokens and gets a $300 Anypad and $375 YAY Games allocations.

Then, they decide to sell their assets and get $9000 ($300*30) and $4875 ($375*13), which leaves them with $13875 of total profit. And all it took was a $1200 investment.

YAY Games and Anypad 70% of public sales’ total supply was sold out during the first hour. That being said, the 24-hour time frame was enough to finalize the sales entirely.

The two projects demonstrated up to a 3000% token price surge. New whitelists will be closed soon in October 2021.

Now, let’s take a closer look into Launchpad’s mechanics.

TruePNL Launchpad: how does it work?

Any crypto startup can benefit from running a fundraiser via the TruePNL Launchpad, creating token exchange pools and launching public or private sales based on smart contracts in the Ethereum and Binance Smart Chain networks.

Launchpad offers a fair distribution model through dedicated pools that help distribute tokens among valid users, filtering out bots and duplicates. It also features two sales models: a standard private one and Initial DEX Offering (IDO) with two pools, whitelist PNLg pool and vested pool.

PNLg pool

PNLg pool provides investors with a guaranteed allocation based on their contribution to the TruePNL ecosystem. The model is simple: the longer you hold your PNL tokens (the platform’s native tokens), the larger allocation you get. The pool is powered by the off-chain PNLg point, demonstrating the value of a user’s contributions.

Joining PNLg pools is open for users holding a PNL token, referrals, and Uniswap’s PNL liquidity providers.

For each PNL help in the wallet, a user receives 1 PNLg token daily. As for Uniswap staking, for every PNL staked in the liquidity pool for PNL/USDC trading pair, the user receives 2.5 PNLg tokens.

Allocation formula

N participants participate in the distribution process, while each user contributes (An) PNLg points to the pool with the sum of all the tokens in the pool indicated as (P). The share (Sn) for each user calculated by the formula is Sn = An / P.

All shares of Sn>4% are taken as 4%. The remaining shares are indicated as Dn, where Dn = Sn–4%. These shares are summed up, and the sum is indicated as R. This remainder (R) is distributed among all the participants whose share (Sn) is less than 4%.

Referrals bring the referrer 20% of all the PNLg points the referral earned. Currently, 55 referrals have successfully used the program, bringing 406 referrals, and counting.

Any amount of the accumulated PNLg tokens can be spent for getting guaranteed allocation in any PNLg pool.

Although the allocation system may not always seem straightforward, a universal rule proves to be working: long-term holders enjoy bigger benefits. Typically, a long-term strategy works due to a token’s upside and extended investment opportunities.

Vested pool

Vested pool offers a slightly different investment mechanism. Investors are free to choose the amount they want to work with, and they get exactly as many tokens as they want and whenever they want.

Furthermore, it is possible to deposit money as many times as one wants, increasing total allocation.

Also, the pool works on a first-come, first-served basis with the maximum sale goal of up to $50,000 available for a larger group of investors.

PNL holders have their benefits, including exclusive investment rights. As for other investors, they may enter the project at the final stage of the sale.

What’s next?

TruePNL has kick-started a new Launchpad sales of Versus Farm, a play-to-earn platform powered by Binance Smart Chain. The project aims to provide users with multiple options to make a profit, including active and passive earnings. Players can earn while playing liquidity games and complete quests for additional rewards.

Versus Farm Whitelist for PNLg holders is open till October 13, 2021 at 2 pm GMT. The PNLg holders are eligible for a 33% discount for this IDO.

TruePNL also is proud to present a new project to rock the launchpad – Flashloans.com.

Flashloans are one of DeFi’s most powerful features, but currently hard to access without a developer skillset, aimed to empower anyone with an Ethereum Web3 wallet to create and execute a flash loan backed trade using the new flashloans tool.

Flashloans.com vested sale is live, and the Whitelist for the public round is open.

The private round is on for PNLg holders, where every 10,000 $PNL holder can join the vested sale and get $500 worth of allocation.

The sale began on October 9, 2021 and the Flashloans.com Whitelist for public sale closes on October 22, 2021 at 3 pm GMT.

The third upcoming project on TruePNL is Shoefy, an innovative decentralized platform offering a combination of non-fungible token (NFT) and fungible token (FT) ecosystem generating passive income.

It is a futuristic NFT project that utilizes cutting-edge DeFi tools to maximize returns by providing options for both farming and staking using its sNFT.

Each NFT is programmatically generated unique digital pair of shoes on the platform.

Users can hold their unique digital sNFT empowered by FT $SHOE token, and at the same time, gain exposure by such DeFi tools as staking and farming, as well as the opportunity to mint unique on-chain algorithmically generated sNFT.

Shoefy Whitelist closes on October 12, 2021 at 3 pm GMT, while the private Vested sale ends on October 16, 2021 at 4 pm GMT, if the allocation won’t be sold out sooner.

There is a full guide on how to join public and private sales on the TruePNL Medium blog.

If you’re planning to participate in other allocations, it’s worth buying more PNL tokens as they will be actively used in the future.

There is still an opportunity to join Versus, Shoefy and Flashloans.com Whitelists here.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.