University of Cambridge Bitcoin Mining Map Shows China’s Hashrate Dropped to 46% – Mining Bitcoin News

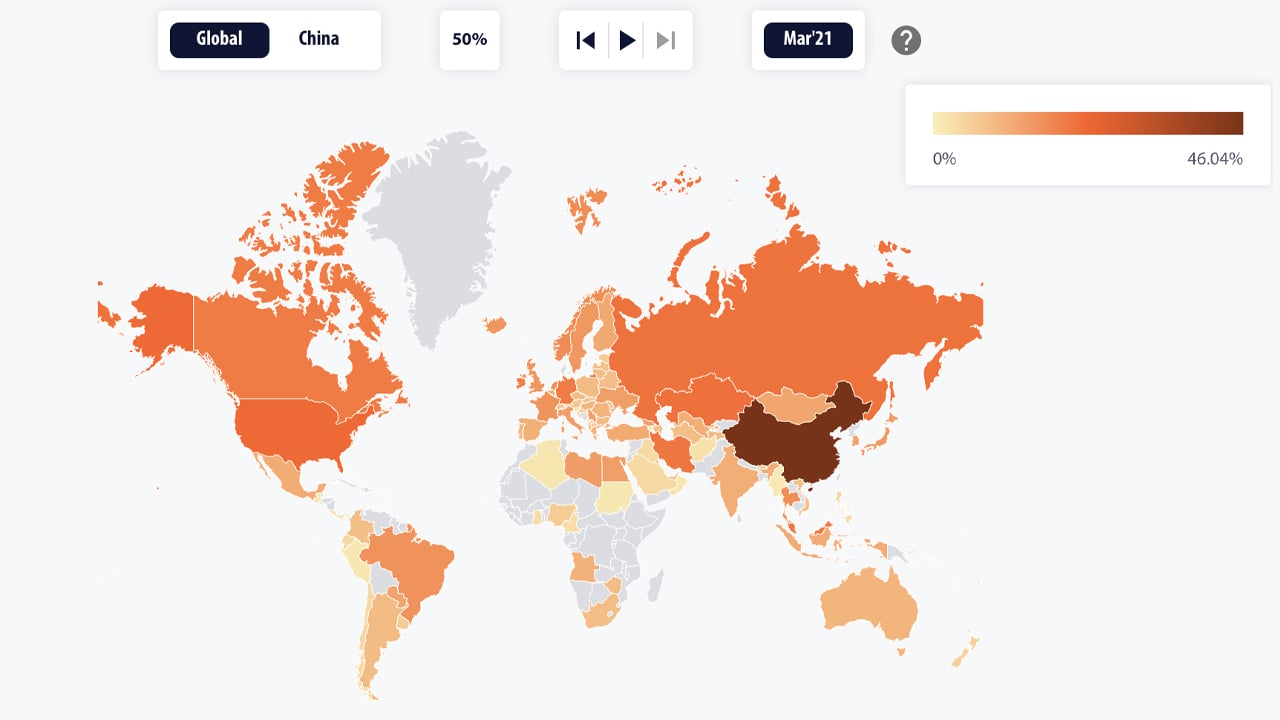

After the researchers from the Cambridge Bitcoin Electricity Consumption Index (CBECI) project said that the website’s “Bitcoin Mining Map” had not been updated since April 2020, the map has finally been updated. Current data from the mining map shows the coverage goes all the way up until April 2021, and the estimate of China’s hashrate dominance is much lower than previous estimates.

New Estimates Show China Has Less Hashrate Than Previous Statistics

University of Cambridge data from the Cambridge Bitcoin Electricity Consumption Index (CBECI) indicates that China has a lot less hashrate dominance than once thought. On June 19, Bitcoin.com News reported on how difficult it was to estimate how much hashrate is actually residing in China.

While writing that specific report, the CBECI project explained on its website that the Bitcoin Mining Map had not been updated since April 2020. Furthermore, in December 2020, Bitcoin.com News was told at the time the “CBECI map hasn’t been updated for some time now” by a University of Cambridge researcher.

Today, that has changed and the CBECI map has a lot more updated information at least up until April 2021. So this means the CBECI map won’t account for the mass migration of Chinese bitcoin miners that followed the month of April.

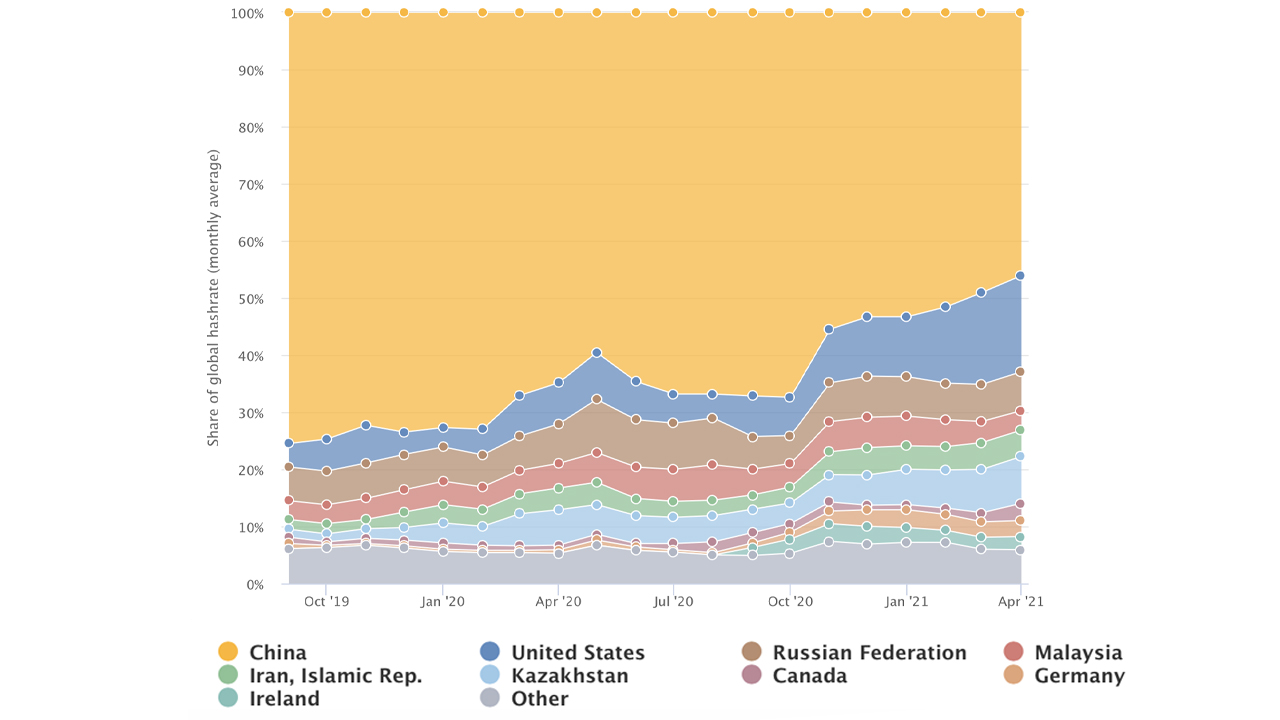

However, the updated CBECI map does show China’s hashrate dominance in April was around 46%. That figure is a lot lower than the older estimate before the update which was 65%. The U.S. captures 16.8% and Kazakhstan follows behind America with 8.19%, according to CBECI’s “Evolution of country share” statistics.

The University of Cambridge researchers leverage sample data from geolocational mining facilities and several bitcoin mining pools. Partners that help contribute to the CBECI map include Poolin, Viabtc, Btc.com, and Foundry.

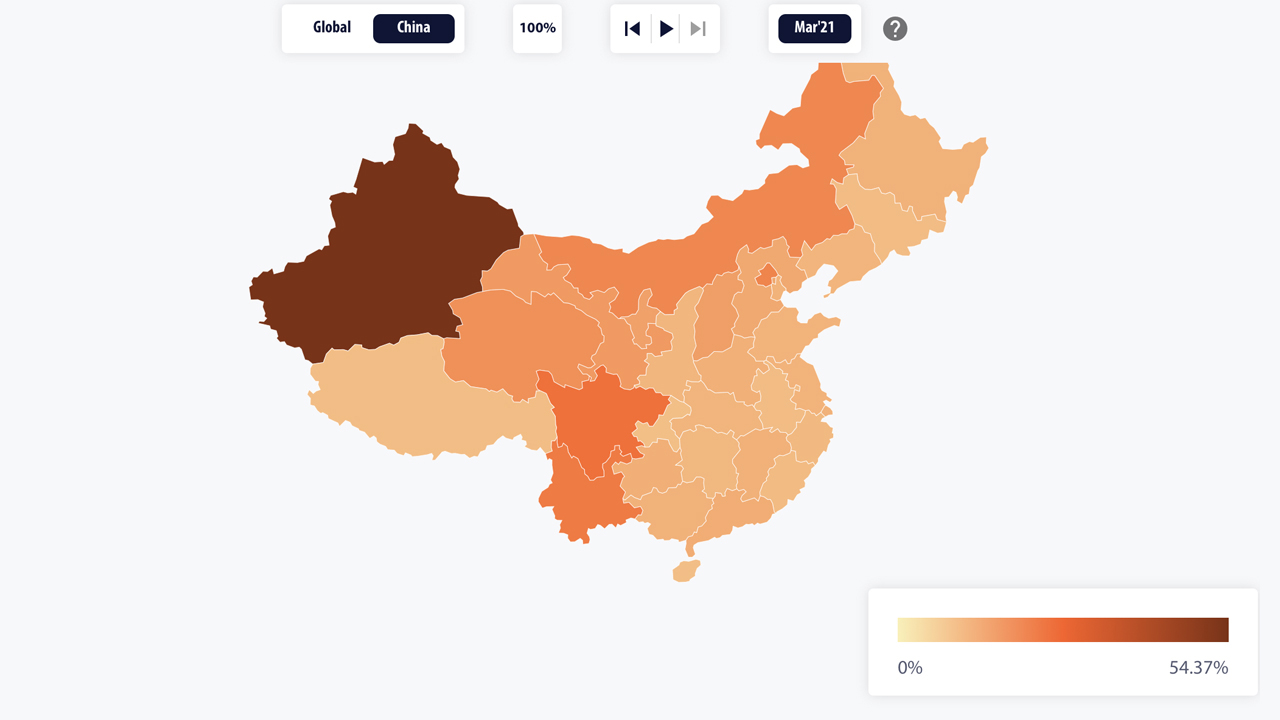

The CBECI map also highlights the “Evolution of Chinese provinces share” in another chart dedicated to these statistics. The dominance of Chinese provinces stem from areas like Sichuan (16.4%), Xinjiang (54.4%), Yunnan (8.7%), Nei Mongol (3.7%), Gansu (1.3%) Zhejiang (0.2%), Beijing (4.8%), Qinghai (2.3%), and unknown regions (8.1%).

As far as other countries besides China, the U.S., and Kazakhstan, the CBECI map shows the Russian Federation has around 6.84% of the global hashrate. This is followed by unknown regions capturing 5.92%, Iran 4.64%, Malaysia 3.44%, Canada 3%, Germany 2.81%, and Ireland 2.27%.

After not updating the data for quite some time, the CBECI research team notes that updates are now “scheduled on a monthly basis and are subject to data availability (generally with a delay of one to three months).”

What do you think about the latest update on how much hashrate is located in China? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Cambridge Bitcoin Electricity Consumption Index (CBECI) mining maps,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.