Bedrock Partners with Chainlink to Fortify Security Post-Hack

Following a $2 million exploit, liquid restaking protocol Bedrock is integrating Chainlink Proof of Reserve.

Such security measures will be necessary to maintain investor confidence during Bedrock’s growth.

Bedrock to Tighten Minting Protocols with Chainlink Integration

Bedrock, a liquid restaking firm, suffered a major exploit on September 26. In its announcement, the Bedrock team claimed that this exploit primarily involved uniBTC, but the firm’s wrapped and reserve BTC were secure.

The “impact” of this exploit was approximately $2 million, mostly in DEX LPs, and Bedrock is working to recover as much of the funds as possible. A more comprehensive post-mortem on the incident will be forthcoming.

Read More: Ethereum Restaking: What Is it and How Does it Work?

In the immediate aftermath of this exploit, the company made another announcement. Moving forward, Bedrock will integrate Chainlink Proof of Reserve (PoR) to increase security overall. In particular, this “industry standard” for security will fortify their minting protocol.

“Chainlink Proof of Reserve will provide Bedrock with automated and verifiable on-chain checks to help ensure the correct backing of reserves, preventing the kind of exploit we experienced today. These transparent verifications, conducted in real-time, will help guarantee that funds remain fully collateralized and protected against manipulation or mishandling”, the announcement claimed.

Integrating Chainlink Proof of Reserve is a critical step in fortifying our protocol and helping ensure the utmost protection of user funds. By leveraging [it], we can provide verifications that all assets are fully collateralized and secure our minting function, providing a reliable and transparent minting process”, said Zhuling, Core Contributor at Bedrock.

Chainlink’s Security Portfolio

This particular incident echoes another that took place four years ago. In 2020, ValueDeFi suffered a $6 million flash loan exploit and afterward integrated Chainlink’s Price Feeds protocol. Since then, the firm has continued conducting prominent security deals, making a deal with 21.co earlier this week. This track record helps explain the company’s bullish price moves lately.

Read More: What Is Chainlink (LINK)?

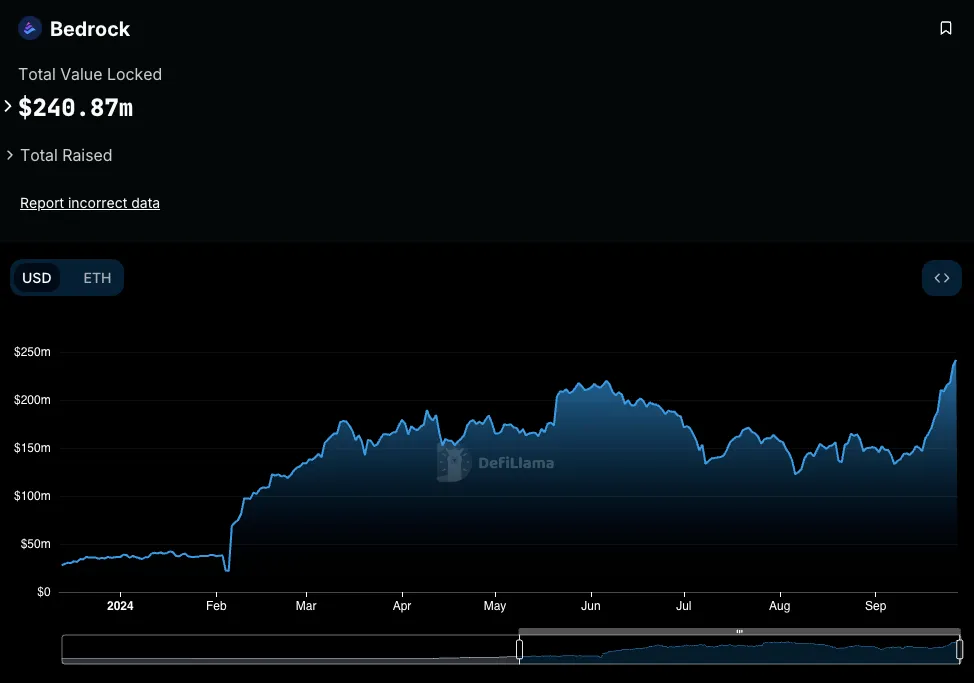

Bedrock was founded recently, in 2023, but its focus on attracting institutional investors has caused it to skyrocket in prominence. According to data from DefiLlama, it’s currently the eighth-largest liquid staking protocol, with over $240 million in total value locked. For Bedrock to continue this rapid rise after such an exploit, investors will need reassurances of security.

“Proof of Reserve will…[provide] users with full transparency around reserves. With the explosion of tokenized assets in our space, Chainlink’s real-time, automated verifications help prevent security exploits related to overminting, hence building trust and safeguarding against vulnerabilities,” claimed Johann Eid, Chainlink’s Chief Business Officer.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.