Why Bitcoin ETF Options Trading Is Key for Institutional Investors?

A CryptoQuant report analyzes the pros and cons of Bitcoin ETF Options Trading, calling it a “significant milestone.” Increased liquidity and institutional investors are bullish signals for Bitcoin.

IBIT options trading may also open the door to increased Bitcoin shorting, but the benefits far outweigh this risk.

Bitcoin ETF Options: An Institutional Milestone

Since the SEC approved options trading on BlackRock’s IBIT ETF in late September, there is a new possibility for dramatic change in the market. This regulatory green light has been anticipated for several months, and the SEC even seems open to a similar deal for Ethereum ETFs. An exclusive report from CryptoQuant can help explain the opportunity.

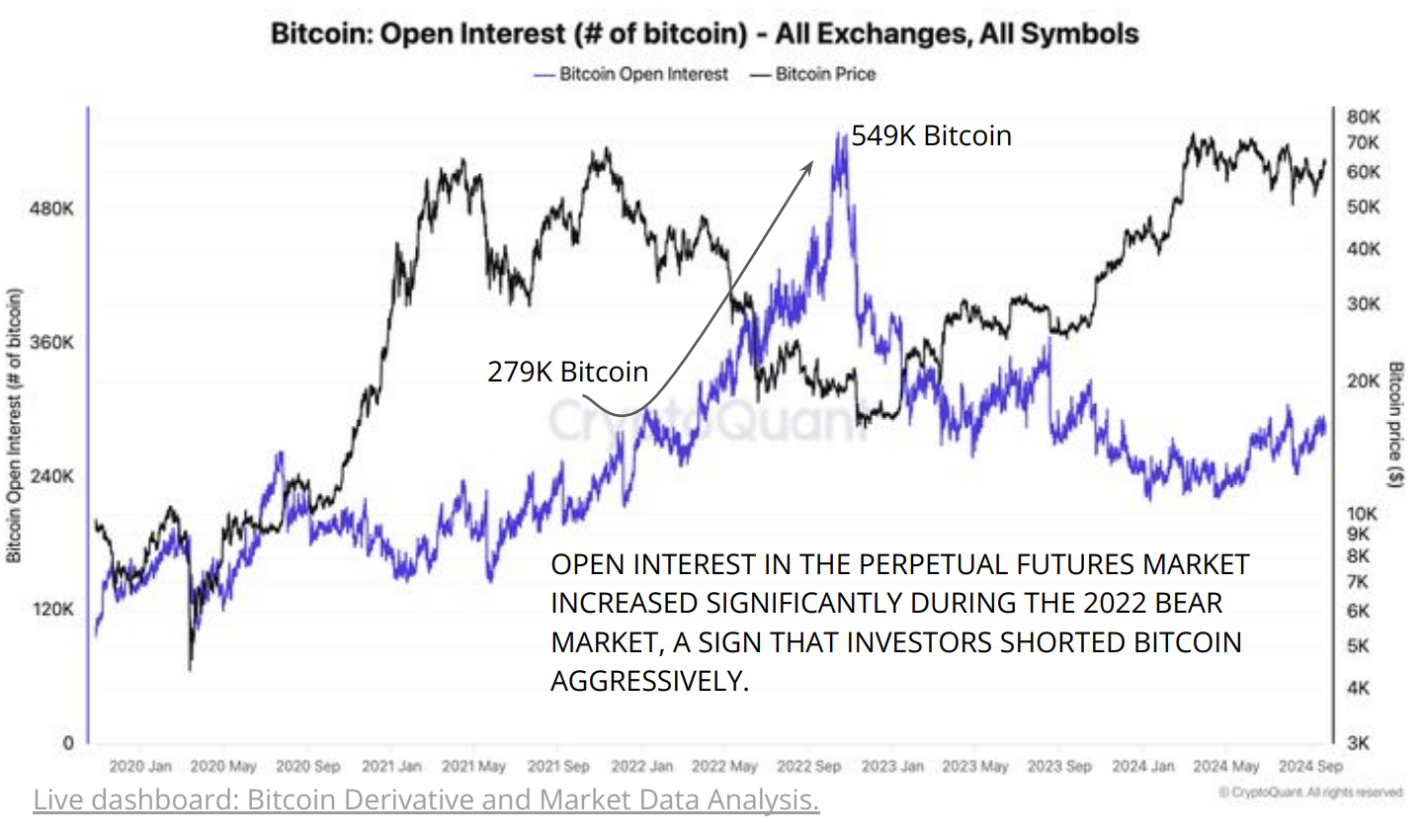

CryptoQuant called the SEC approval a “significant milestone”, and outlined a number of benefits to the market. For one thing, it’s very powerful even when considered as a symbolic victory. Open Interest for Bitcoin options trading increased by nearly fivefold from March 2023 to the ETF approval one year later, and options trading on IBIT cracks open a versatile new market.

“The decision highlights the increasing integration of cryptocurrency into traditional financial markets, following a growing trend of regulatory acceptance of Bitcoin-related financial products. The approval would increase liquidity and investor participation in the Bitcoin market, marking a further step toward broader institutional adoption”, CryptoQuant claimed.

Read More: An Introduction to Crypto Options Trading

CryptoQuant’s report largely focuses on the approvals’ concrete benefits, however, and not symbolic ones. For one thing, its data claims that options traders tend to skew more long-term in their investment options than futures traders. In the pre-existing Bitcoin options market, nearly half of all options have an expiry date of five months of more, compared to a majority of futures trades expiring in less than three.

Liquidity and Financial Instruments

The new options trades will also diversify traders’ financial instruments, helping increase liquidity in the markets overall. This mirrors Eric Balchunas’ sentiment that these IBIT options will attract more liquidity and more large traders. One prominent example of these new tools is the ability to sell covered calls.

“Investors that hold spot Bitcoin can sell call options and collect the premium from the call option, getting yield from their Bitcoin holdings in a regulated way”, the report claimed.

Read More: Shorting Bitcoin: How It Works and Where You Can Do It In 2024

However, these options are also likely to increase the “paper” supply of Bitcoin. Increasingly sophisticated methods of Bitcoin exposure do not involve Bitcoin exchanging hands, and that’s not always a good thing. In the past, this increased paper supply has actually led to aggressive shorting against Bitcoin, a bearish signal.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.