Bitcoin ETFs see third-largest daily inflow amidst rate cut anticipation

Share this article

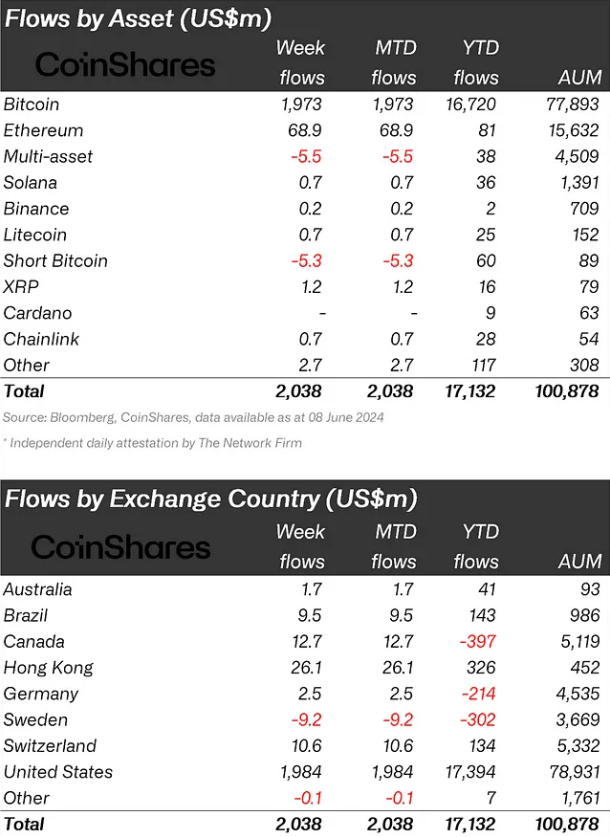

Crypto investment products saw a massive inflow of $2 billion so far in June, fuelled by the expectation around rate cuts in the US. According to asset management firm CoinShares, these products saw a cumulative $4.3 billion inflow for the past five weeks.

Bitcoin continued to be the primary focus of investors, with inflows of $1.97 billion for the week. Conversely, short Bitcoin products experienced outflows for the third consecutive week, totaling $5.3 million.

Ethereum also saw a notable uptick in interest, with its best week of inflows since March, totaling $69 million. This is likely a response to the unexpected SEC decision to permit spot-based ETFs. Meanwhile, the rest of the altcoins experienced less activity, though Fantom and XRP stood out with inflows of $1.4 million and $1.2 million, respectively.

Regionally, the US registered the majority of inflows observed, amounting to $1.98 billion in the last week alone, with the first day of the week witnessing the third-largest daily inflow on record. The iShares Bitcoin ETF has now overtaken the Grayscale Bitcoin Trust, boasting $21 billion in assets under management.

Hong Kong came second, surpassing $26 million last week and also amounting to the second-largest year-to-date inflow volume of $326 million.

Trading volumes for crypto exchange-traded products (ETPs) surged to $12.8 billion for the week, marking a 55% increase from the previous week. In a notable shift, inflows were recorded across nearly all providers, while the usual outflows from established firms slowed down.

CoinShares’ analysts attribute this change in market sentiment to weaker-than-expected US macroeconomic data, which has led to anticipations of monetary policy rate cuts. The positive market movement pushed the total assets under management above the $100 billion threshold for the first time since March of this year.

Share this article