Bitcoin Price Drops To $26,900- US Retail Sales To Lift BTC This Week?

Join Our Telegram channel to stay up to date on breaking news coverage

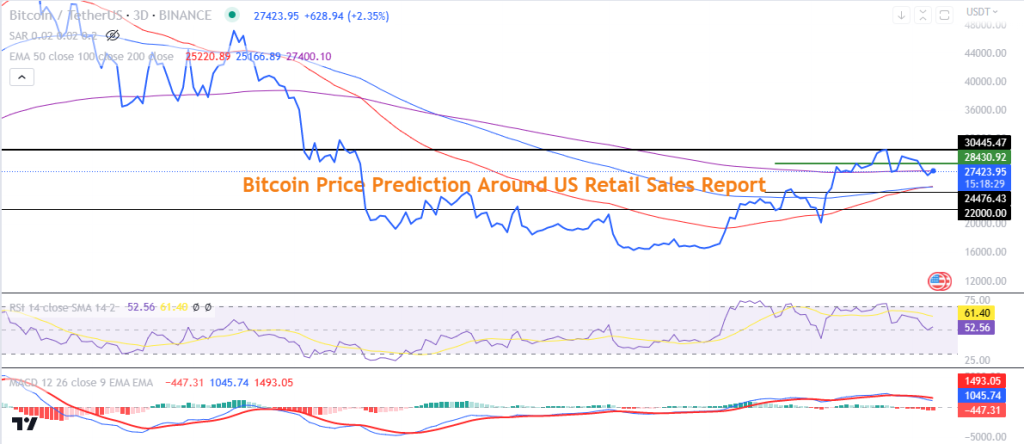

Bitcoin (BTC) price has displayed massive volatility since late March, when it started consolidating between the $30,445 and $26,500 levels. The fluctuations came as the king crypto maneuvered the waves of macroeconomic events in the United States. From consumer spending, employment figures, Gross Domestic Product (GDP), inflation, home sales, and Consumer Price Index (CPI), among other indicators, BTC has responded accordingly.

This week Bitcoin may have to react to the retail sales report, another macroeconomic indicator known to influence the crypto market. The Department of Commerce’s monthly release on retail and food services sales is an indication of consumer spending health. This report shows retail sales in various sectors, such as department stores, furniture stores, and home furnishing stores.

US Retail Sales Report

The retail sales report for April will be announced on Tuesday, May 16, offering insight into the sentiment among consumers as inflation cools.

Based on economists’ predictions, the Census Bureau will report a 0.7% increase in overall retail sales from the previous months. If the numbers come as forecasted, it will be crucial for Bitcoin price considering the recorded declines of the past two months. More specifically, it will reverse the drop of 0.6% in March.

In an attempt to justify the expected increase, analysts at Credit Suisse opine that vigorous spending on cars and fuel will drive the surge. On the month-over-month metric, the broker speculates a decline of 0.2%.

Nevertheless, there are mixed sentiments for the outlook in retail sales given the current strength in the labor market, and wages may support consumer spending. Notably, however, this comes amid speculation of a recession, among other factors. These include tougher financial conditions and slowing inflation, which tend to ridge spending.

In a statement last week, the Bureau of Labor Statistics said:

US inflation slowed its rise more than expected in April as the Federal Reserve’s interest rate increases continue to dent price rises.

It is worth mentioning that smaller price increases have the typical effect of slowing retail spending growth.

Bitcoin Price In Relation To US Retail Sales

Noteworthy, retail sales data is an important indicator of the US economy’s health because consumer spending contributes a notable portion of GDP. Accordingly, the expected 0.7% increase in retail sales could indicate that the US economy is booming. While news that the US economy is not slowing down could be positive for traditional financial markets, it is negative news for crypto.

Cryptocurrencies such as BTC are likely to suffer from a booming US economy because investors are often driven toward the US dollar (USD) during times of economic certainty. Therefore, the impact of the retail sales data on Bitcoin prices will hinge upon investors’ interpretation of the news.

Narratives To Expect

Better-than-expected sales figures, or an increase thereof, could decrease BTC prices as investors shift their focus back to traditional assets.

Conversely, a larger-than-expected decline in retail sales could increase BTC prices as investors seek safe-haven assets.

Overall, the upcoming release of retail sales data is expected to have some level of impact on financial markets and could influence the Bitcoin price in the short term. Noteworthy, however, the impact for BTC may not be as notable considering its abysmal performance around the CPI release last week.

Bitcoin Price Prediction

Bitcoin is trading at $27,260 at the time of writing, a daily rise of 2.2%, with a 36% increase in 24-hour trading volume. The uptick, which has broken the freefall, comes as traders ride the retail sales report expectation and are therefore readying for a reaction in BTC price.

An increase in buying pressure from the current level could see the flagship crypto shatter above the immediate barricade at $28,430 and, in a highly bullish case, tag the $30,445 resistance level, thereby reclaiming the mid-April highs. Such a move would denote a 10% upswing.

The bullish outlook draws support from several indicators. For starters, the Exponential Moving Average (EMA) provided robust support downward. The 200-day EMA at $27,398 provided an easy entry point for sidelined investors as it acted as a supplier congestion level.

Downward, Bitcoin price enjoyed sturdy support from the confluence between the 50- and 100-day EMA at $25,214 and $25, 163 respectively.

Further, the Relative Strength Index (RSI) had crossed above the mean line, indicating a bullish lead. At 52, the RSI suggested that there was more room for the upside even as more buyers flocked to the market. Similarly, the Moving Average Convergence Divergence (MACD) was also in the positive region above the mean line, more evidence of bullish control.

On the flip side, if buyer momentum eases, bears could easily recover the market and send Bitcoin price downward. In such a case, BTC could revisit the confluence between the 50- and 100-day EMA before a southbound extension leading it to the $24,476 support level to the mid-March lows.

In the dire case, Bitcoin’s price could drop to the $22,000 level, constituting a 20% downswing.

BTC Alternative

Switch your gaze from Bitcoin price and consider ECOTERRA, the ticker for the Ecoterra ecosystem.

Ecoterra is a green web3 startup poised to reap success after a successful presale. Thus far, the project is underway with the presale for the $ECOTERRA token, boasting over $3.65 million in token sales. Three days ago, the project was celebrating a $3.5 million milestone, which makes the current figure more impressive.

🚨⚡Attention, ecoterra fam

‼️We have just reached $3,500,000 milestone‼️

The #Presale is selling fast🚀

Grab your $ECOTERRA before the price goes up!https://t.co/1fYkPOsPYG pic.twitter.com/70vckfRQ2b

— ecoterra (@ecoterraio) May 12, 2023

As the presale sales numbers continue frothing, this environmentally-focused project is raising half a million dollars weekly. With this in mind, the message is clear: time is running out for investors. As others line up to be part of the project before the token experiences an increase of more than 10% in its value, now is the time to buy ECOTERRA.

Don’t miss out on your chance to be part of the eco-friendly #crypto revolution ♻️👀

🔥Current price: 1 ECOTERRA = $0.00775 USD

Get in the $ECOTERRA #Presale now and secure your tokens before it’s too late ⬇️https://t.co/XTOxx2CWFp pic.twitter.com/NNyWhzuALi

— ICO Mars (@Icomars) May 15, 2023

The project’s success draws from the fact that it is the first entity with a Recycle-to-Earn (R2E) model. It seeks to “promote recycling, lessen reused materials exchange, and carbon footprint reduction.”

The above features were key in earning the Ecoterra project an award during the recent Blockchain Summit in Istanbul.

A special thanks to @BEconomy_HQ and all attendees of the 2023 Istanbul summit!

We’re honoured to receive recognition for our contribution to the sustainable crypto ecosystem 🏆

At ecoterra, we’re committed to making a positive impact and will continue striving to do better! pic.twitter.com/nyV1rLAH4j

— ecoterra (@ecoterraio) May 12, 2023

The award was a testament and acknowledgment of the project’s contribution to sustainability by leveraging a cryptographic environment. Citing a statement on social media, the company said, “We’re honored to receive recognition for our contribution to the sustainable crypto ecosystem.”

As part of the project’s future, they plan to raise the token’s price by 10% once the presale raise hits $3.925 million. When this happens, ECOTERRA price will go from the current $0.00775 per token to $0.0085.

Further, come the end of 2023, the project will enter different cryptocurrency exchanges with a listing price of $0.01. This will see early investors enjoy profits of up to 30%.

Visit Ecoterra here

Read More:

Ecoterra – New Eco Friendly Crypto

CertiK Audited

Doxxed Professional Team

Earn Free Crypto for Recycling

Gamified Environmental Action

Presale Live Now – $2M+ Raised

Yahoo Finance, Cointelegraph Featured Project

Join Our Telegram channel to stay up to date on breaking news coverage