Bitcoin Price Prediction As BTC Trades Near $17,000 –

Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) price continues to trade within the confines of a descending parallel channel, adding credence to the prevailing bearish market conditions. Large volume transactions valued above $1 million have also reached a historical low as interest for BTC among whales continues to deteriorate.

The largest asset by market cap in the market is witnessing historically low volatility, so much so that miners have sold almost all Bitcoin mined throughout 2022. The outcome has sparked a debate over whether the sales created a persistent headwind for Bitcoin´s price. César Nuez, a technical analyst at Bolsamanía weighs in on this debate arguing:

Bitcoin maintains a complicated technical look. The ‘crypto’ continues to shape a pullback to 18,000 and everything seems to indicate that we could end up seeing an attack on the $14,925 support. If it loses this price level, the most normal thing is that we will end up seeing an extension of the falls to $10,000.

On Wednesday, December 28, BTC losses exceeded 1.27% to bring the big crypto further away from the $17,000 resistance level. The current price of Bitcoin is $16,644, which is significantly lower than its pre-crash value, but the quintessential crypto still ranks first with a market cap of $321 billion, according to data from CoinMarketCap.

Bitcoin Whale Activity Hints A Continued Price Drop

Large wallet investors and their activities on the Bitcoin network have typically influenced the BTC price. According to data from crypto intelligence tracker Santiment, Bitcoin’s ranging prices overlapped with declining whale interest.

Bitcoin Whale Transactions

As can be seen in the chart, Bitcoin price correlates with transactions worth $1 million or more. Analysts at Santiment believe that if the price of the flagship crypto continues to dip while whale transactions are dropping, then this would mark a historic bearsh signal for the largest asset by market cap.

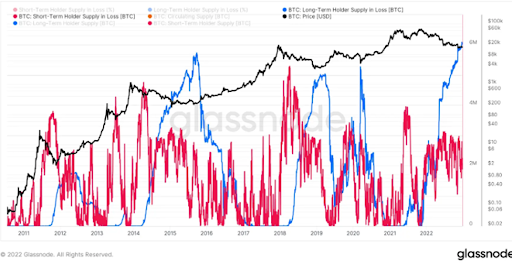

In the midst of stark price drops for the people’s crypto, holders continue to nurse their losses. From the chart, Bitcoin hodlers sit on a historical 8 million BTC in unrealized losses.

On-chain analytics firm Glassnode has also revealed data showing that both short-term and long-term holders sit on more unrealized losses than ever before.

BTC Short-term Holder Suply

However, the turnout records a crucial milestone in the BTC price trend amid the current bear market and points to the possibility of whale activity and large volume transactions triggering a breakout for Bitcoin, if whale transactions increase hence forth.

Bitcoin Price Supressed By The 50 SMA

Bitcoin price action shows that the digital asset has been in a consolidating between the $16,415 support level and the $16,936 barrier for the last eight days. This is validated by the flattening of the relative strength index (RSI) and the horizontal movement of the moving average convergence divergence indicator (MACD) close to the zero line. This suggested that the buying and selling pressure were balancing out.

The Bitcoin price was trading at $16,644 at presstime, down 1% percent in the last 24 hours. The analysis also indicates that the crypto was trading in second straight bullish session as bears focus on demoting the flagship asset further down.

In the short term, the bearish momentum is expected to continue. The major support level for the BTC price is at $16,415. Increased overhead pressure could see the coin drop lower toward the $16,000 psychological level or the lower boundary of the prevailing chart pattern at $15,474.

BTC/USD Daily Chart

On the upside, the 50-day simple moving average (SMA) on the daily chart is presently the immediate hurdle that the BTC bulls were fighting, and if broken, would see the price break past the resistance offered by the upper trend line of the channel around the $16,936 area.

In highly bullish cases, Bitcoin price may rise to meet the next resistance at $17,500. Nevertheless, the asset would have a lot of ground to cover before reaching its major resistance level embraced by the 100-day SMA sitting at $18,220. Any more gains might push the price towards the $20,000 zone where the 200-day SMA lies.

In the short term, the pioneer cryptocurrency may continue consolidating in the said range until a directional bias is established.

Other Projects To Consider in 2023

The constant state of volatility characteristic of the crypto market is legendary. Accordingly, investors make fortunes and losses with each rise and fall. However, there is no need to gnaw your nails or fret in anxiety, hoping your investment strategies will pay off so you can earn more than what you lose. With the right project, the chances of making a profit are higher, and amid this financial uncertainty, these new tokens represent a ray of hope.

Dash 2 Trade (D2T)

Dash 2 Trade is a cryptocurrency platform offering important tools and expert cryptocurrency insights that will upscale your trading. By delivering an excellent crypto analytics dashboard, Dash 2 Trade offers users full access to a reliable scoring system for cryptocurrency initial coin offerings (ICOs), professional market and social analysis, trading signals, social and technical indicators, and Auto Trading API, among others.

Currently, over 82% of the presale tokens have already been sold, with the platform raising $11 million.

🚨ANNOUNCEMENT🚨

‼️A new milestone accomplished!!

🔥$11 Million raised🔥

We are already in stage 4, the FINAL stage of our presale! 🔥🚀

Hurry up and join the presale now – before the exchange listings⬇️https://t.co/PMdwCfAHt1 pic.twitter.com/RIGdqFyMEu

— Dash 2 Trade (@dash2_trade) December 27, 2022

The presale will end within the next eight days and the first CEX listing will go live on January 11, 2023.

Visit Dash 2 Trade Here

C+Charge (CCHG)

C+Charge is one of the most revolutionary green crypto projects that have taken off in the crypto market. It defines a new blockchain-based peer-to-peer (P2P) payment system for electric vehicle (EV) charging.

With C-Charge, users pay for the power on their stations with the project’s utility crypto coin dubbed CCHG, and for every charge of the power, the user is rewarded with carbon credits. In this way, users can contribute to the reduction of carbon gas emissions while at the same time earning money.

#EV drivers can locate the nearest charging stations with real-time data on the C+Charge app without any effort 😎

Fill your bags with $CCHG to secure your journey with us 🔥🔥

Join our presale today! ⬇️https://t.co/ixe18bPqzI pic.twitter.com/ZDaWBUjs50

— C+Charge (@C_Charge_Token) December 27, 2022

The CCHG presale is currently live, and you can purchase tokens for as little as $0.013 apiece. The following round of the presale will raise this price to $0.0165, and subsequent rounds will do the same.

Visit C+Charge here

More News:

FightOut (FGHT) – Newest Move to Earn Project

CertiK audited & CoinSniper KYC Verified

Early Stage Presale Live Now

Earn Free Crypto & Meet Fitness Goals

LBank Labs Project

Partnered with Transak, Block Media

Staking Rewards & Bonuses

Join Our Telegram channel to stay up to date on breaking news coverage