Compound, Synthetix Attempt to Break Out

Key Takeaways

Compound is up by nearly 34% over the past three days.

Synthetix has also risen by more than 26% over the same period.

COMP and SNX appear to have more room to go up if they keep the recent gains.

Share this article

Compound and Synthetix appear to be headed to greener pastures after posting over 26% gains in the last few days. Still, the pioneer cryptocurrency, Bitcoin, shows a few red flags.

Compound and Synthetix Take the Lead

Compound and Synthetix have seen their native tokens increase significantly in market value, outperforming some of the most popular DeFi projects.

COMP has surged by nearly 34% over the past three days and is now testing the $152 resistance level. This hurdle is significant for the DeFi token because it sits around the descending trendline of a falling wedge that has been forming on the weekly chart since late June 2021.

A sustained weekly candlestick close above $152 could signal a breakout from the consolidation pattern. Under such circumstances, sidelined investors could re-enter the market, pushing COMP by roughly 52% toward $224.50.

It is worth noting that this is the third consecutive time that Compound has tried to breach the $152 resistance level. For this reason, it is imperative to wait for a decisive close above it to target higher highs.

Failing to print a weekly candlestick close above $152 could result in a steep correction to the wedge’s descending trendline at $93. If this support level breaks, the losses can extend toward $50.

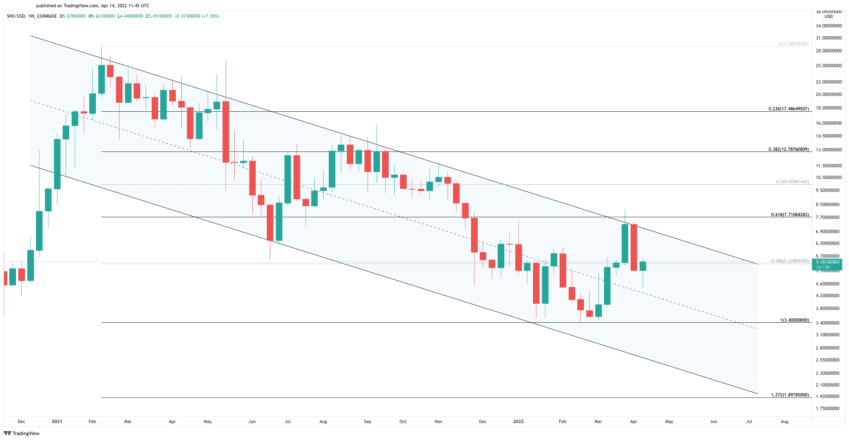

SNX has also posted significant gains over the past three days. The DeFi token saw its price rise by more than 26% after testing the middle trendline of a parallel channel where it has been contained since December 2020.

Price history shows that Synthetix tends to surge to the channel’s upper boundary when the pattern’s middle trendline acts as support. Similar price action could result in a 37% upswing to $7.70. But if this resistance level breaks, SNX might enter a new uptrend to $17.50.

It is worth noting that a rejection from the $7.70 resistance level can result in a steep correction to the channel’s middle or lower trendline. These support levels sit at $3.40 and $2, respectively.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

A Guide to Yield Farming, Staking, and Liquidity Mining

Yield farming is arguably the most popular way to earn a return on crypto assets. Essentially, you can earn passive income by depositing crypto into a liquidity pool. You can think of these liquidity…

Compound Surges on Plans to Cut Rewards

Compound has reached a crucial resistance level after the DeFi startup revealed plans to eliminate its rewards distribution program. Further buying pressure around the current price levels could push COMP…

Ethereum DeFi Tokens Aave, Maker, Synthetix Lead Market Surge

Ethereum DeFi protocols Aave, Maker, and Synthetix have seen their tokens rally on the back of new protocol upgrades and proposed growth strategies. DeFi Blue Chips Bounce Back After a…

New Ethereum Token Could Replace Yield-Bearing DeFi Assets

A new Ethereum token standard called ERC-4626 could help solve composability issues in DeFi and make yield-bearing tokens more secure. Meet ERC-4626 DeFi natives may soon need to familiarize themselves…