$4.6 Billion Bitcoin, Ethereum Options Expire as US Markets Shift

The crypto market is bracing for heightened volatility as nearly $4.6 billion worth of Bitcoin (BTC) and Ethereum (ETH) options expire today.

This event comes after the US elections and the Federal Open Market Committee (FOMC) meeting. These two US macro developments were the driving forces behind Bitcoin sentiment this week.

US Elections, FOMC Drive Crypto Market Sentiment Ahead of Major Options Expiry

According to data from Deribit, 48,794 Bitcoin options contracts worth approximately $3.7 billion will expire on November 8. These contracts have a put-to-call ratio of 0.72 and a maximum pain point of $69,000.

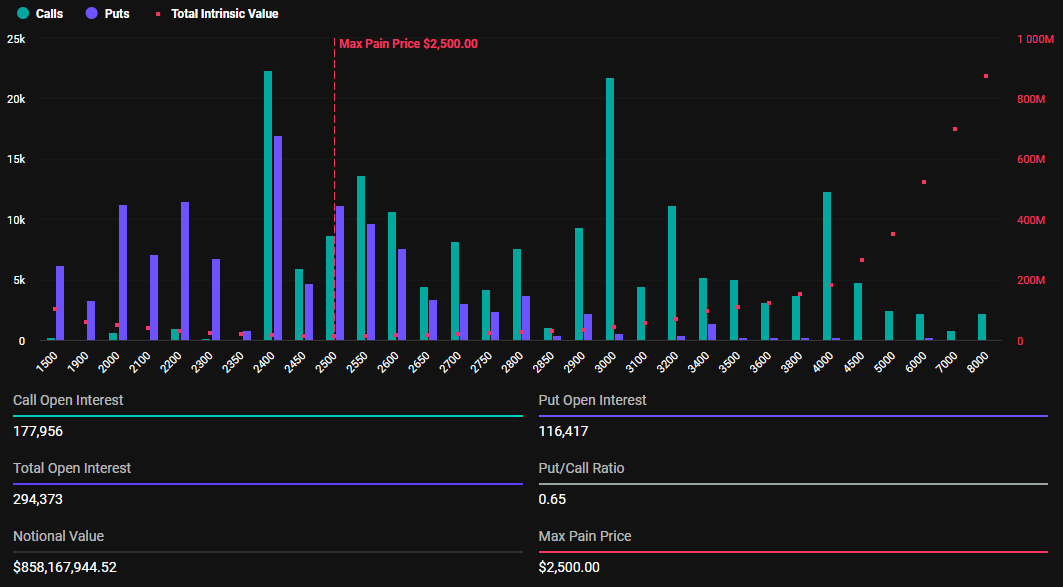

Similarly, Ethereum’s options market is set to expire with 294,380 contracts worth $854.88 million. Today’s expiring Ethereum contracts have a put-to-call ratio of 0.65, with a maximum pain point of $2,500.

Read more: An Introduction to Crypto Options Trading.

In options trading, the maximum pain point is the level at which option holders would suffer the largest losses. It is essentially the price at which the highest number of options (both calls and puts) would expire worthless, inflicting maximum financial “pain” on traders.

Meanwhile, the put-to-call ratio gauges market sentiment by comparing the number of put options (bets on price declines) to call options (bets on price increases).

According to Deribit, the hype around the elections saw trading volumes rise to a daily all-time high of $10.8 billion on November 6. This was as expectations for a Donald Trump victory peaked. This coincided with BTC reordering what was then its all-time high at $75,100.

Greeks.live’s recent analysis outlined the impact of the recent US elections on today’s expiring crypto options contracts. The analysts noted that as the hype around Donald Trump’s victory fades, the options market is closing out profit-taking to end the election season.

“The election market is rapidly cooling off. Despite strong gains in both Bitcoin and Ether and optimistic sentiment in the crypto market, the options market is closing out profit taking in a noticeable way to end the election game,” they wrote.

Further, Greeks.live observes that Bitcoin doomsday options have fallen below 50%. A doomsday option is added to a contract to allow either the issuer or investor to redeem the contract early.

Similarly, the analysts say implied volatility (IV) is down significantly across all major terms, with ETH benefiting from today’s big gains and falling back less than BTC. Meanwhile, large holders are already planning ahead.

“Large investors have begun to lay out the end of the year market or even next year’s spring market,” the analysts added.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

Elsewhere, the FOMC decided to cut interest rates by 25 basis points (0.25%). The Federal Reserve (Fed) chair, Jerome Powell, indicated that “raising rates is not our plan.” The remarks came amid acknowledgment that people are still feeling the effects of high prices.

More interestingly, the Fed chair said he would not resign if asked to do so, cognizant of Trump’s plans to overhaul US crypto rules beyond the SEC (Securities and Exchange Commission).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.