16 Tweets by MicroStrategy CEO and USD 5B in Bitcoin, How Has BTC Reacted?

MicroStrategy, the US software company led by the prominent bitcoin (BTC) bull Michael Saylor, has since August of 2020 been on a bitcoin buying spree like nothing the world has ever seen. But how has the price of the number one cryptocurrency reacted to the massive purchases? We took a look to find out.

As reported on Monday this week, MicroStrategy is again in the news after it announced its latest purchase of another BTC 5,050, which the CEO said was acquired at an average price of USD 48,099.

So far, MicroStrategy’s bitcoin purchases have totaled BTC 114,042, worth more than USD 5.47bn at current prices. And according to Bloomberg, MicroStrategy’s bitcoin holdings now even “dwarf the traditional corporate treasuries of most members of the S&P 500 Index.”

The coins held by MicroStrategy have been accumulated over a number of separate purchases, made in market conditions ranging from those in September last year when BTC was under USD 16,000, to purchases made around the peak of this year’s bull market at over USD 64,000.

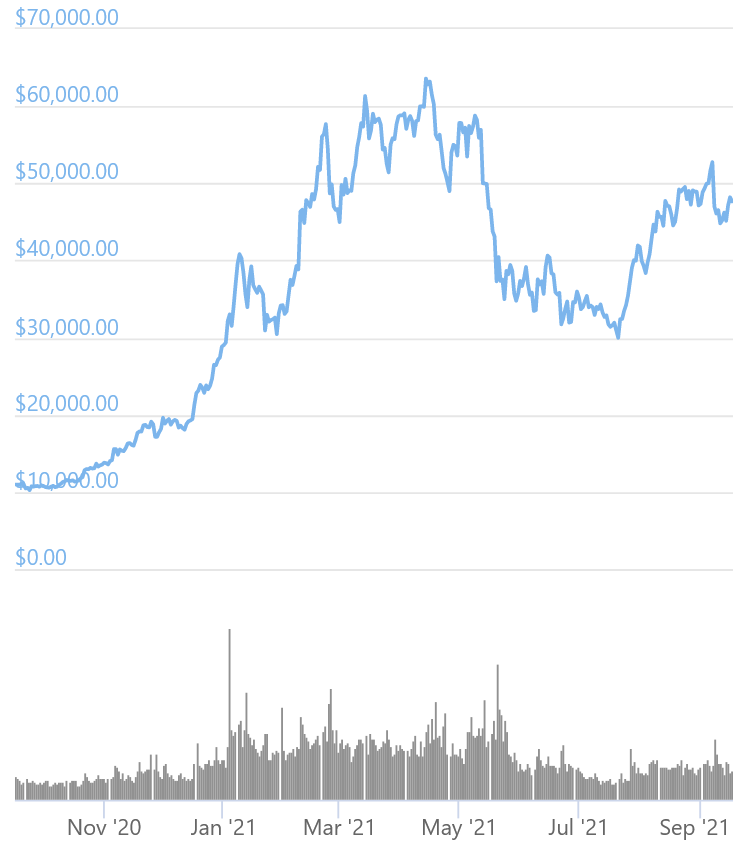

BTC price in the past 12 months:

So, starting with the first purchase last year, let’s see what has happened.

(Price changes are measured from the date and time of the announcement per Michael Saylor’s tweets).

1. August 11, 2020

MicroStrategy announces that it has made a first purchase of BTC 21,454 for USD 250m and that it “adopts bitcoin as primary treasury reserve asset” for the company to hold.

Despite being down on the day of the announcement, the bitcoin price rose by more than 8% over the six next days to a peak of about USD 12,300.

Change in 24 hours: -2%

2. September 15, 2020

The company announces that it has acquired an additional 16,796 bitcoin for a total amount of USD 175m.

This time, bitcoin traded up by about 3% on the day of the news, and continued to rise by another 3%-4% over the next five days before a temporary selloff occurred.

Change in 24 hours: +3%

3. December 4, 2020

MicroStrategy announces the purchase of BTC 2,574, bought for an aggregated amount of USD 50m.

Following the announcement, BTC saw mixed price action over the next week. However, the announcement came after a rally that had already taken the price of bitcoin up 82% since the company’s previous purchase.

Change in 24 hours: +1%

4. December 21, 2020

MicroStrategy said it has purchased another BTC 29,646 for a total amount of USD 650m.

The bitcoin price saw an immediate spike higher following this purchase announcement, which was also followed by steadily rising prices over the next few days. The announcement marked MicroStrategy’s largest purchase to date in terms of the amount bitcoin acquired.

Change in 24 hours: +5%

5. January 22, 2021

The company announced the purchase of BTC 314 for USD 10m.

Bitcoin traded up by about 4% in the eight hours following the announcement, but went into a selloff later in the day that ultimately brought the price lower than it was before the announcement.

Change in 24 hours: -1.4%

6. February 2, 2021

The company announces it has purchased BTC 295 for a total of USD 10m.

This time, bitcoin was more or less unchanged for the first five hours after the announcement. After that, however, the coin entered a bull-run that over the next few weeks brought it to its all-time high of over USD 64,000.

Change in 24 hours: +5%

7. February 24, 2021

MicroStrategy announced the purchase of another BTC 19,452 BTC for USD 1.026bn.

This announcement marked MicroStrategy’s biggest purchase announcement to date in US dollar terms, with over a billion dollars worth of bitcoin acquired. Despite this, bitcoin’s initial reaction after the tweet was published was to trade lower, before a slight recovery started over the next few hours. Over the next few days, the price also traded largely lower, after having recently dipped below the USD 50k mark.

Change in 24 hours: +1%

8. March 1, 2021

MicroStrategy says it has bought another BTC 328 for a total of USD 15m.

On this day, bitcoin traded higher both over the short- and long-term after the announcement, sending it north of USD 60,000 within 10 days of the announcement.

Change in 24 hours: +2%

9. March 5, 2021

MicroStrategy announced the purchase of BTC 205 for USD 10m.

The day marked the beginning of a week-long bull-run for bitcoin, with the price moving higher for seven consecutive days. In total for the week, the price moved up by nearly 27% to over USD 61,000.

Change in 24 hours: -0.7%

10. March 12, 2021

MicroStrategy announces that 262 more bitcoins have been purchased for USD 15m.

Bitcoin traded higher both in the hours immediately following the announcement, as well as on the next day.

Change in 24 hours: +6%

11. April 5, 2021

The company says it has acquired BTC 253 for USD 15m.

Following this announcement, bitcoin traded down briefly, before ultimately moving higher to its all-time high of over USD 64,000 within nine days.

Change in 24 hours: +1%

12. May 13, 2021

The company announced the purchase of BTC 271 for USD 15m.

Despite a brief move higher, bitcoin was at this point already breaking down from its uptrend leading up to April’s all-time high. Saylor was still buying the dip, while bitcoin ended up falling by more than 25% over the next six days.

Change in 24 hours: +1%

13. May 18, 2021

The company said it has bought BTC 229 for USD 10m.

Still in the middle of its May selloff, this relatively small MicroStrategy’s bitcoin purchase was not enough to change the direction of the market, which was moving down sharply.

Change in 24 hours: -24%

14. June 21, 2021

MicroStrategy on this day said it has bought BTC 13,005 for USD 489m.

This announcement from Michael Saylor came as bitcoin had already traded lower for several days. And although the immediate reaction was a further selloff, the price levels here were close to bitcoin’s bottom so far in 2021 of around USD 30,000.

Change in 24 hours: -8%

15. August 24, 2021

The company announced that it had purchased BTC 3,907 for a total of USD 177m during the period from July 1 to August 23 this year.

The bitcoin market moved largely lower over the next few hours and days until the end of the month.

Change in 24 hours: -3%

16. September 13, 2021

The company said that it purchased 5,050 additional BTC for USD 243m.

Coinciding with the widely reported Walmart fake news report, the bitcoin price moved up sharply within a few hours of Saylor’s announcement before it again saw an even bigger crash. However, the market was still up by nearly 7% within two days of the announcement.

Change in 24 hours: +4%

______

Based on what we have seen above, it seems clear that trading purely based on Michael Saylor’s bitcoin purchase announcements is a futile strategy.

In reality, it’s extremely difficult to say exactly what is driving a large and volatile market like bitcoin over the short term, even if we look at the hours immediately following major announcements like those from MicroStrategy.

Over the long-term, however, there’s no doubt that MicroStrategy is contributing to the success of bitcoin, and that it has taken a massive amount of coins off the market. As a result, there are even fewer coins around for the rest of us to chase after.

Michael Saylor and his company appears to be very strong holders. But given that MicroStrategy still has not been through a drawdown in price like the one we saw during the 2018 bear market, only time will tell just how strong of a holder Michael Saylor really is.

In June, the company itself discussed two scenarios when they might sell some of their BTC:

They may sell bitcoin in future periods as needed to generate cash for treasury management and other general corporate purposes.Also, if their business is not able to continue to generate cash flow from operations in the future sufficient to service their debt and make necessary capital expenditures, they may be required to “adopt one or more alternatives, such as selling bitcoin or other assets” among other alternatives.

______Learn more: – This Is When MicroStrategy Might Sell Bitcoin According to Arthur Hayes- Fed May Have Indirectly Invested In MicroStrategy’s Bitcoin Drive

– MicroStrategy CEO On Buying Bitcoin While Trillions ‘Melting’ In Treasuries

– This Is How Musk’s and Saylor’s Tweets Steer Bitcoin Price- Bitcoin Mega Bull MicroStrategy CEO Gives Hope To Ethereum, Altcoins